U-Haul 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 I AMERCO ANNUAL REPORT

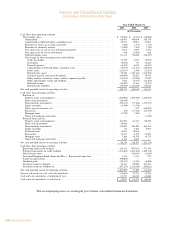

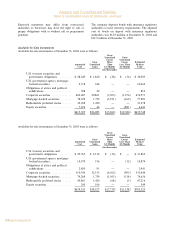

Note 8: Investment and Interest Income Net

Investmentandinterestincome,netwereasfollows:

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

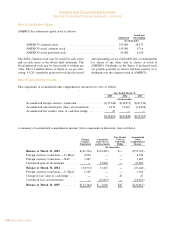

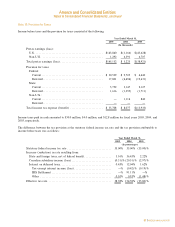

Note 8: Investment and Interest Income Net

Investment and interest income, net were as follows:

Year Ended March 31,

2005 2004 2003

(In thousands)

Fixed maturities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $21,085 $ 23,002 $ 35,952

Real estate ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 12,836 10,879 3,578

Insurance policy loans ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 160 498 Ì

Mortgage loans ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 6,312 7,173 35

Short-term, amounts held by ceding reinsurers, net and other

investments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (2,442) 1,616 (3,044)

Investment income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 37,951 43,168 36,521

Less investment expensesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (3,154) (6,511) (1,112)

Investment income-related partyÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 21,942 1,624 5,322

Investment and interest income, netÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $56,739 $ 38,281 $ 40,731

Investment expenses include costs incurred in the management of the investment portfolio and interest

credited on annuity policies.

Interest income increased in fiscal 2005 compared with fiscal 2004 primarily as a result of the

deconsolidation of SAC Holding Corporation.

On June 30, 2003, the Company's insurance subsidiaries exchanged their investments in Private Mini

Storage Realty, L.P. (""Private Mini'') which, at the time of the exchange had a carrying value of zero, for

other real property owned by the SAC entities. The exchanges were non-monetary and were recorded on the

basis of the book value of the assets exchanged.

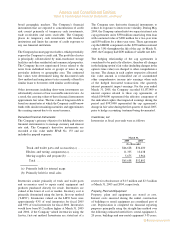

Note 9: Borrowings

Long-Term Debt

Long-term debt at fiscal year-ends was as follows:

March 31,

2005 2004

(In thousands)

Revolving credit facility, senior secured first lienÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 84,862 $164,057

Senior amortizing notes, secured, first lien, due 2009 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 346,500 350,000

Senior notes, secured second lien, 9.0% interest rate, due 2009 ÏÏÏÏÏÏÏÏÏÏ 200,000 200,000

Senior subordinated notes, secured, 12.0% interest rate, due 2011 ÏÏÏÏÏÏÏ 148,646 148,646

Total AMERCO notes and loans payableÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $780,008 $862,703

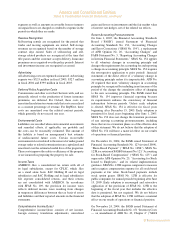

First Lien Senior Secured Notes

The Company has a First Lien Senior Secured credit facility, due 2009 in the amount of $550 million,

with a banking syndicate led and arranged by Wells Fargo Foothill, a part of Wells Fargo & Company (the

""Senior Secured Facility''). These senior notes consist of two components, a $200 million revolving credit

facility (including a $50 million letter of credit sub-facility) and a $350 million amortizing term loan.

F-19

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

Note 8: Investment and Interest Income Net

Investment and interest income, net were as follows:

Year Ended March 31,

2005 2004 2003

(In thousands)

Fixed maturities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $21,085 $ 23,002 $ 35,952

Real estate ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 12,836 10,879 3,578

Insurance policy loans ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 160 498 Ì

Mortgage loans ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 6,312 7,173 35

Short-term, amounts held by ceding reinsurers, net and other

investments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (2,442) 1,616 (3,044)

Investment income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 37,951 43,168 36,521

Less investment expensesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (3,154) (6,511) (1,112)

Investment income-related partyÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 21,942 1,624 5,322

Investment and interest income, netÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $56,739 $ 38,281 $ 40,731

Investment expenses include costs incurred in the management of the investment portfolio and interest

credited on annuity policies.

Interest income increased in fiscal 2005 compared with fiscal 2004 primarily as a result of the

deconsolidation of SAC Holding Corporation.

On June 30, 2003, the Company's insurance subsidiaries exchanged their investments in Private Mini

Storage Realty, L.P. (""Private Mini'') which, at the time of the exchange had a carrying value of zero, for

other real property owned by the SAC entities. The exchanges were non-monetary and were recorded on the

basis of the book value of the assets exchanged.

Note 9: Borrowings

Long-Term Debt

Long-term debt at fiscal year-ends was as follows:

March 31,

2005 2004

(In thousands)

Revolving credit facility, senior secured first lienÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 84,862 $164,057

Senior amortizing notes, secured, first lien, due 2009 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 346,500 350,000

Senior notes, secured second lien, 9.0% interest rate, due 2009 ÏÏÏÏÏÏÏÏÏÏ 200,000 200,000

Senior subordinated notes, secured, 12.0% interest rate, due 2011 ÏÏÏÏÏÏÏ 148,646 148,646

Total AMERCO notes and loans payableÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $780,008 $862,703

First Lien Senior Secured Notes

The Company has a First Lien Senior Secured credit facility, due 2009 in the amount of $550 million,

with a banking syndicate led and arranged by Wells Fargo Foothill, a part of Wells Fargo & Company (the

""Senior Secured Facility''). These senior notes consist of two components, a $200 million revolving credit

facility (including a $50 million letter of credit sub-facility) and a $350 million amortizing term loan.

F-19

Amerco and Consolidated Entities

Notes to Consolidated Financial Statements, continued

Investmentexpensesincludecostsincurredinthemanagement

of the investment portfolio and interest credited on annuity

policies.

Interestincomeincreasedinfiscal2005comparedwith

fiscal2004primarilyasaresultofthedeconsolidationof

SACHoldingCorporation.

OnJune30,2003,theCompany’sinsurancesubsidiaries

exchanged their investments in Private Mini Storage

Realty, L.P. (“Private Mini”) which, at the time of the

exchange had a carrying value of zero, for other real

propertyownedbytheSACentities.Theexchangeswere

non-monetaryandwererecordedonthebasisofthebook

valueoftheassetsexchanged.

Note 9: Borrowings

Long-Term Debt

Long-termdebtatfiscalyear-endswasasfollows:

First Lien Senior Secured Notes

The Company has a First Lien Senior Secured credit

facility, due 2009 in the amount of $550 million, with

a banking syndicate led and arranged by Wells Fargo

Foothill,apartofWellsFargo&Company(the“Senior

Secured Facility”). These senior notes consist of two

components, a $200 million revolving credit facility

(includinga$50millionletterofcreditsub-facility)and

a$350millionamortizingtermloan.