Tyson Foods 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

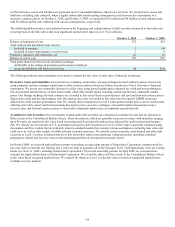

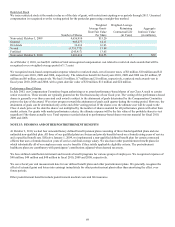

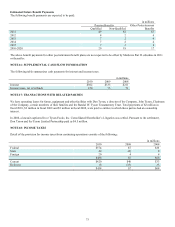

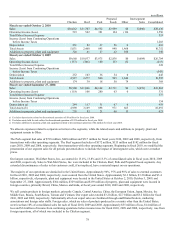

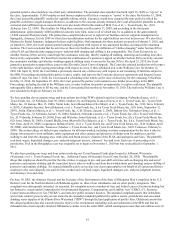

Estimated Future Benefit Payments

The following benefit payments are expected to be paid:

in millions

Pension Benefits Other Postretirement

Qualified Non-Qualified Benefits

2011 $9 $2 $7

2012 8 2 6

2013 7 2 4

2014 7 2 4

2015 7 3 4

2016-2020 29 18 17

The above benefit payments for other postretirement benefit plans are not expected to be offset by Medicare Part D subsidies in 2011

or thereafter.

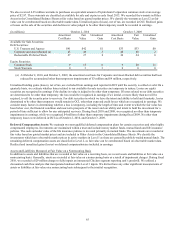

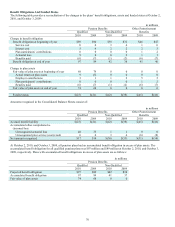

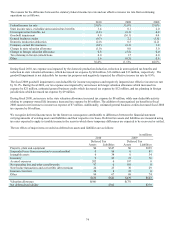

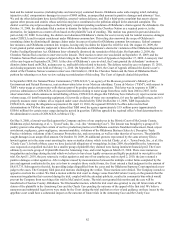

NOTE 16: SUPPLEMENTAL CASH FLOW INFORMATION

The following table summarizes cash payments for interest and income taxes:

in millions

2010 2009 2008

Interest $302 $333 $211

Income taxes, net of refunds 470 35 51

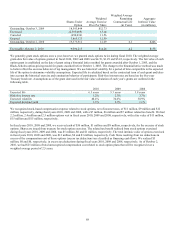

NOTE 17: TRANSACTIONS WITH RELATED PARTIES

We have operating leases for farms, equipment and other facilities with Don Tyson, a director of the Company, John Tyson, Chairman

of the Company, certain members of their families and the Randal W. Tyson Testamentary Trust. Total payments of $2 million in

fiscal 2010, $3 million in fiscal 2009 and $3 million in fiscal 2008, were paid to entities in which these parties had an ownership

interest.

In 2008, a lawsuit captioned In re Tyson Foods, Inc. Consolidated Shareholder’s Litigation was settled. Pursuant to the settlement,

Don Tyson and the Tyson Limited Partnership paid us $4.5 million.

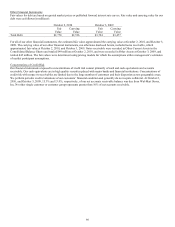

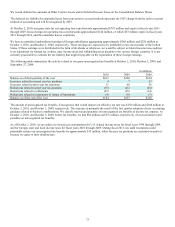

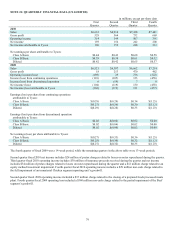

NOTE 18: INCOME TAXES

Detail of the provision for income taxes from continuing operations consists of the following:

in millions

2010 2009 2008

Federal $374 $7 $56

State 44 (4) 8

Foreign 20 4 4

$438 $7 $68

Current $420 $40 $33

Deferred 18 (33) 35

$438 $7 $68