Tyson Foods 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

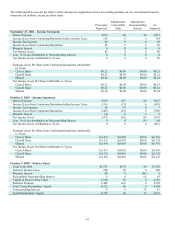

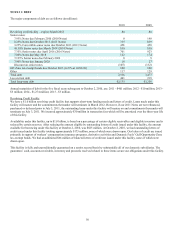

In January 2008, we announced the decision to restructure operations at our Emporia, Kansas, beef plant. Beef slaughter operations

ceased during the second quarter of fiscal 2008. However, the facility is still used to process certain commodity, specialty cuts and

ground beef, as well as a cold storage and distribution warehouse. This restructuring resulted in elimination of approximately 1,700

jobs at the Emporia plant. In fiscal 2008, we recorded charges of $10 million for impairment charges and $7 million of other closing

costs, consisting of $6 million for employee termination benefits and $1 million in other plant-closing related liabilities. These

amounts were reflected in the Beef segment’s Operating Income (Loss) and included in the Consolidated Statements of Income in

Other Charges. We have fully paid employee termination benefits and other plant-closing related liabilities.

In fiscal 2008, management approved plans for implementation of certain recommendations resulting from the previously announced

FAST initiative, which was focused on process improvement and efficiency creation. As a result, in fiscal 2008, we recorded charges

of $6 million related to employee termination benefits resulting from termination of approximately 200 employees. Of these charges,

$2 million, $2 million, $1 million and $1 million, respectively, were recorded in the Chicken, Beef, Pork and Prepared Foods

segments’ Operating Income (Loss) and included in the Consolidated Statements of Income in Other Charges. We have fully paid the

employee termination benefits.

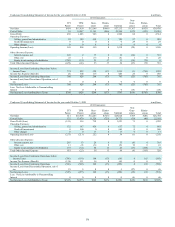

NOTE 6: DERIVATIVE FINANCIAL INSTRUMENTS

Our business operations give rise to certain market risk exposures mostly due to changes in commodity prices, foreign currency

exchange rates and interest rates. We manage a portion of these risks through the use of derivative financial instruments, primarily

futures and options, to reduce our exposure to commodity price risk, foreign currency risk and interest rate risk. Forward contracts on

various commodities, including grains, livestock and energy, are primarily entered into to manage the price risk associated with

forecasted purchases of these inputs used in our production processes. Foreign exchange forward contracts are entered into to manage

the fluctuations in foreign currency exchange rates, primarily as a result of certain receivable and payable balances. We also

periodically utilize interest rate swaps to manage interest rate risk associated with our variable-rate borrowings.

Our risk management programs are periodically reviewed by our Board of Directors’ Audit Committee. These programs are monitored

by senior management and may be revised as market conditions dictate. Our current risk management programs utilize industry-

standard models that take into account the implicit cost of hedging. Risks associated with our market risks and those created by

derivative instruments and the fair values are strictly monitored at all times, using Value-at-Risk and stress tests. Credit risks

associated with our derivative contracts are not significant as we minimize counterparty concentrations, utilize margin accounts or

letters of credit, and deal with credit-worthy counterparties. Additionally, our derivative contracts are mostly short-term in duration

and we generally do not make use of credit-risk-related contingent features. No significant concentrations of credit risk existed at

October 2, 2010.

We recognize all derivative instruments as either assets or liabilities at fair value in the Consolidated Balance Sheets, with the

exception of normal purchases and normal sales expected to result in physical delivery. The accounting for changes in the fair value

(i.e., gains or losses) of a derivative instrument depends on whether it has been designated and qualifies as part of a hedging

relationship and the type of hedging relationship. For those derivative instruments that are designated and qualify as hedging

instruments, we designate the hedging instrument based upon the exposure being hedged (i.e., fair value hedge, cash flow hedge, or

hedge of a net investment in a foreign operation). We qualify, or designate, a derivative financial instrument as a hedge when contract

terms closely mirror those of the hedged item, providing a high degree of risk reduction and correlation. If a derivative instrument is

accounted for as a hedge, depending on the nature of the hedge, changes in the fair value of the instrument either will be offset against

the change in fair value of the hedged assets, liabilities or firm commitments through earnings, or be recognized in other

comprehensive income (loss) (OCI) until the hedged item is recognized in earnings. The ineffective portion of an instrument’s change

in fair value is recognized in earnings immediately. We designate certain forward contracts as follows:

● Cash Flow Hedges – include certain commodity forward and option contracts of forecasted purchases (i.e., grains) and

certain foreign exchange forward contracts.

● Fair Value Hedges – include certain commodity forward contracts of forecasted purchases (i.e., livestock).

● Net Investment Hedges – include certain foreign currency forward contracts of permanently invested capital in certain

foreign subsidiaries.