Tyson Foods 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

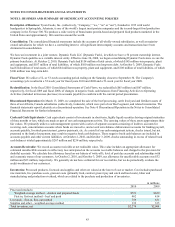

Cash flow hedges

Derivative instruments, such as futures and options, are designated as hedges against changes in the amount of future cash flows related to

procurement of certain commodities utilized in our production processes. We do not purchase forward and option commodity contracts

in excess of our physical consumption requirements and generally do not hedge forecasted transactions beyond 18 months. The

objective of these hedges is to reduce the variability of cash flows associated with the forecasted purchase of those commodities. For

the derivative instruments we designate and qualify as a cash flow hedge, the effective portion of the gain or loss on the derivative is

reported as a component of OCI and reclassified into earnings in the same period or periods during which the hedged transaction affects

earnings. Gains and losses representing hedge ineffectiveness are recognized in earnings in the current period. Ineffectiveness related to

our cash flow hedges was not significant during fiscal 2010, 2009 and 2008.

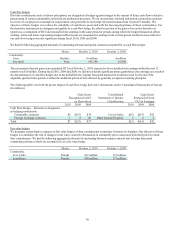

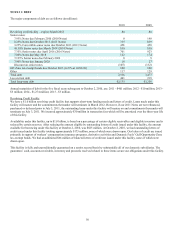

We had the following aggregated notionals of outstanding forward and option contracts accounted for as cash flow hedges:

Metric October 2, 2010 October 3, 2009

Commodity:

Corn Bushels 16 million 4 million

Soy meal Tons 101,500 16,900

The net amount of pretax gains in accumulated OCI as of October 2, 2010, expected to be reclassified into earnings within the next 12

months was $10 million. During fiscal 2010, 2009 and 2008, we did not reclassify significant pretax gains/losses into earnings as a result of

the discontinuance of cash flow hedges due to the probability the original forecasted transaction would not occur by the end of the

originally specified time period or within the additional period of time allowed by generally accepted accounting principles.

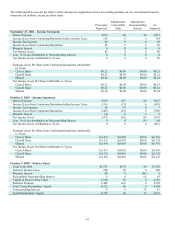

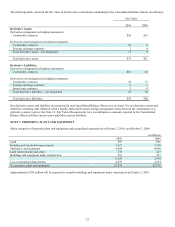

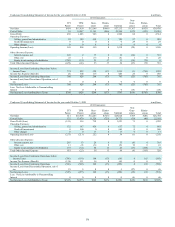

The following table sets forth the pretax impact of cash flow hedge derivative instruments on the Consolidated Statements of Income

(in millions):

Gain/(Loss) Consolidated Gain/(Loss)

Recognized in OCI Statements of Income Reclassified from

on Derivatives Classification OCI to Earnings

2010 2009 2008 2010 2009 2008

Cash Flow Hedge – Derivatives designated

as hedging instruments:

Commodity contracts $6 $(61) $39 Cost of Sales $(6) $(67) $42

Foreign exchange contracts 1 8 (2) Other Income/Expense 1 6 0

Total $7 $(53) $37 $(5) $(61) $42

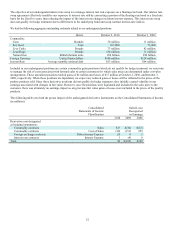

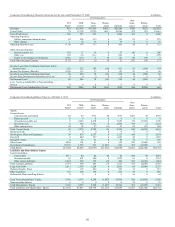

Fair value hedges

We designate certain futures contracts as fair value hedges of firm commitments to purchase livestock for slaughter. Our objective of these

hedges is to minimize the risk of changes in fair value created by fluctuations in commodity prices associated with fixed price livestock

firm commitments. We had the following aggregated notionals of outstanding forward contracts entered into to hedge forecasted

commodity purchases which are accounted for as a fair value hedge:

Metric October 2, 2010 October 3, 2009

Commodity:

Live Cattle Pounds 361 million 133 million

Lean Hogs Pounds 508 million 171 million