Supercuts 2002 Annual Report Download - page 46

Download and view the complete annual report

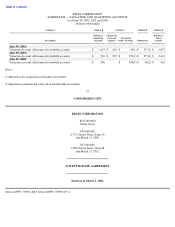

Please find page 46 of the 2002 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. SALE AND PURCHASE OF NOTES.

Subject to the terms and conditions of this Agreement, the Company will issue and sell to you and each of the other purchasers named in

Schedule A (the "Other Purchasers"), and you and the Other Purchasers will purchase from the Company, at the Closing provided for in

Section 3, Notes of the series and in the principal amount specified opposite your names in Schedule A at the purchase price of 100% of the

principal amount thereof. Your obligation hereunder and the obligations of the Other Purchasers are several and not joint obligations and you

shall have no liability to any Person for the performance or non-performance by any Other Purchaser hereunder.

3. CLOSING.

The sale and purchase of the Notes to be purchased by you and the Other Purchasers shall occur at the offices of Gardner, Carton & Douglas,

Quaker Tower, Suite 3400, 321 North Clark Street, Chicago, Illinois 60610 at 9:00 a.m., Chicago time, at a closing (the "Closing") on March 7,

2002 or on such other Business Day thereafter on or prior to March 28, 2002 as may be agreed upon by the Company and you and the Other

Purchasers. At the Closing the Company will deliver to you the Notes to be purchased by you in the form of a single Note (or such greater

number of Notes in denominations of at least $500,000 as you may request) dated the date of the Closing and registered in your name (or in the

name of your nominee), against delivery by you to the Company or its order of immediately available funds in the amount of the purchase price

therefor by wire transfer of immediately available funds for the account of the Company to account number 2347093, at LaSalle Bank, 135

South LaSalle Street, Chicago, IL 60603, ABA #071000505. If at the Closing the Company fails to tender such Notes to you as provided above

in this Section 3, or any of the conditions specified in Section 4 shall not have been fulfilled to your satisfaction, you shall, at your election, be

relieved of all further obligations under this Agreement, without thereby waiving any rights you may have by reason of such failure or such

nonfulfillment.

4. CONDITIONS TO CLOSING.

Your obligation to purchase and pay for the Notes to be sold to you at the Closing is subject to the fulfillment to your satisfaction, prior to or at

the Closing, of the following conditions:

4.1. REPRESENTATIONS AND WARRANTIES.

The representations and warranties of the Company in this Agreement shall be correct when made and at the time of the Closing.

4.2. PERFORMANCE; NO DEFAULT.

The Company shall have performed and complied with all agreements and conditions contained in this Agreement required to be performed or

complied with by it prior to or at the Closing and after giving effect to the issue and sale of the Notes (and the application of the proceeds

thereof as contemplated by Schedule 5.14) no Default or Event of Default shall

2