Supercuts 2002 Annual Report Download - page 147

Download and view the complete annual report

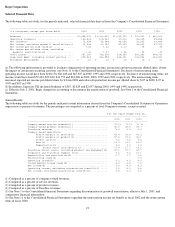

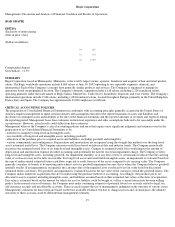

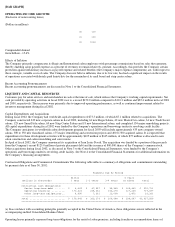

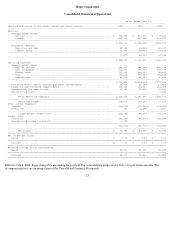

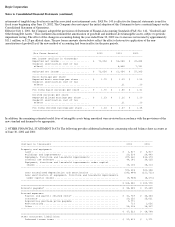

Please find page 147 of the 2002 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.[BAR GRAPH]

OPERATING INCOME GROWTH

(Exclusive of nonrecurring items)

(Dollars in millions)

Compounded Annual

Growth Rate - 15.6%

Effects of Inflation

The Company primarily compensates its Regis and International salon employees with percentage commissions based on sales they generate,

thereby enabling salon payroll expense as a percent of revenues to remain relatively constant. Accordingly, this provides the Company certain

protection against inflationary increases as payroll expense and related benefits (the Company's major expense components) are, with respect to

these concepts, variable costs of sales. The Company does not believe inflation, due to its low rate, has had a significant impact on the results

of operations associated with hourly paid hairstylists for the remainder of its mall based and strip center salons.

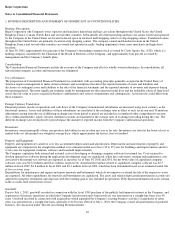

Recent Accounting Pronouncements

Recent accounting pronouncements are discussed in Note 1 to the Consolidated Financial Statements.

LIQUIDITY AND CAPITAL RESOURCES

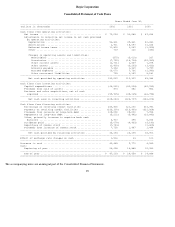

Customers pay for salon services and merchandise in cash at the time of sale, which reduces the Company's working capital requirements. Net

cash provided by operating activities in fiscal 2002 rose to a record $152.0 million compared to $110.3 million and $85.4 million in fiscal 2001

and 2000, respectively. The increases were primarily due to improved operating performance, as well as continued improvement related to

inventory management during fiscal 2002.

Capital Expenditures and Acquisitions

During fiscal 2002, the Company had worldwide capital expenditures of $73.3 million, of which $7.1 million related to acquisitions. The

Company constructed 349 new corporate salons in fiscal 2002, including 61 new Regis Salons, 42 new MasterCuts salons, 34 new Trade Secret

salons, 125 new SmartStyle salons, 69 new Strip Center Salons and 18 new International salons, and completed 134 major remodeling projects.

All capital expenditures during fiscal 2002 were funded by the Company's operations and borrowings under its revolving credit facility.

The Company anticipates its worldwide salon development program for fiscal 2003 will include approximately 435 new company-owned

salons, 300 to 350 new franchised salons, 175 major remodeling and conversion projects and 400 to 500 acquired salons. It is expected that

expenditures for these development activities will be approximately $125 million to $145 million, of which $75 million is allocated to new

salon construction and salon remodeling and conversions.

In April of fiscal 2002, the Company announced its acquisition of Jean Louis David. The acquisition was funded by a portion of the proceeds

from the Company's recent $125.0 million of private placement debt and the issuance of 800,000 shares of the Company's common stock.

Other acquisitions during fiscal 2002, as discussed in Note 3 to the Consolidated Financial Statements, were funded by the Company's

operations and borrowings under its revolving credit facility. See Note 4 to the Consolidated Financial Statements for additional information on

the Company's financing arrangements.

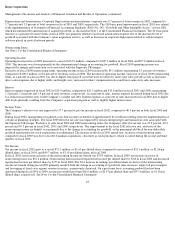

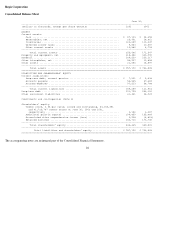

Contractual Obligations and Commercial Commitments The following table reflects a summary of obligations and commitments outstanding

by payment date as of June 30, 2002:

(a) In accordance with accounting principles generally accepted in the United States of America, these obligations are not reflected in the

accompanying audited Consolidated Balance Sheet.

Operating leases primarily represent long

-

term obligations for the rental of salon premises, including franchisee accommodation leases of

00 100

01 109

02 $134

Payments Due By Period

------------------------------------------------------------------------------------------------

Within 5 Years

(Dollars in thousands) 1 Year 1-2 Years 3-4 Years or After Total

------------------------------------------------------------------------------------------------

Contractual cash obligations:

Senior long-term debt ........ $ 4,369 $ 87,557 $ 35,345 $ 165,440 $ 292,711

Operating leases(a) .......... 170,626 268,361 153,275 127,235 719,497

Other long-term obligations... 4,050 7,361 12,068 1,872 25,351

------------------------------------------------------------------------------------------------

Total .......................... $ 179,045 $ 363,279 $ 200,688 $ 294,547 $1,037,559

================================================================================================