Supercuts 2002 Annual Report Download - page 159

Download and view the complete annual report

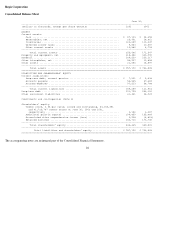

Please find page 159 of the 2002 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Certain intangible asset amounts set forth above are based on preliminary purchase price allocations associated with recent business

acquisitions, and are subject to finalization and adjustment.

All intangible assets have been assigned an estimated finite useful life, and are amortized on a straight-line basis over the number of years that

approximate their respective useful lives (ranging from four to 30 years). The straight-line method of amortization allocates the cost of the

intangible assets to earnings in proportion to the amount of economic benefits obtained by the Company in that reporting period. Total

amortization expense related to other intangible assets during the years ended June 30 2002, 2001 and 2000 was approximately $2.3 million,

$1.4 million and $1.0 million, respectively. As of June 30, 2002, future estimated amortization expense related to amortizable intangible assets

will be:

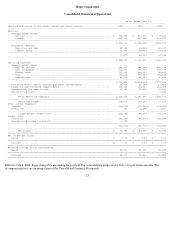

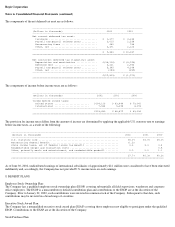

The following provides additional information concerning the Company's transaction and restructuring liabilities related to its fiscal 2000

merger with Supercuts UK, its fiscal 1999 mergers and its restructuring liability related to its fiscal 1999 restructuring plan for its international

operations.

The restructuring liability at June 30, 2002 relates to the October 31, 1999 merger with Supercuts UK and will be satisfied through periodic

contractual payments by the end of fiscal 2004. In conjunction with the merger, the Company recorded a pre-tax merger and transaction charge

of $3.1 million in the second quarter of fiscal 2000. This charge included approximately $2.6 million for severance and other costs principally

associated with the closure of Supercuts UK's headquarters. Severance expense covered the termination of approximately 11 employees of

Supercuts UK who had duplicate positions within the corporate office functions. The charge also included approximately $0.5 million for

professional fees including investment banking, legal, accounting and miscellaneous transaction costs. See Note 11 for a listing of nonrecurring

fiscal 2000 merger related activity included in operating income.

The following table sets forth a reconciliation of shares used in the computation of basic and diluted earnings per share:

---------------------------------------------------------------------------------------------------------------------

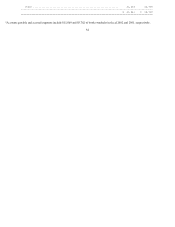

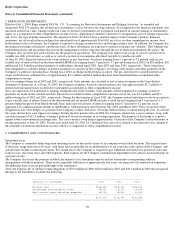

2002 2001

------------------------------------ ------------------------------------

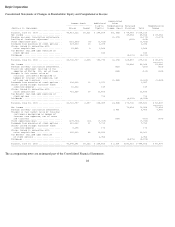

Accumulated Accumulated

(Dollars in thousands) Cost Amortization Net Cost Amortization Net

---------------------------------------------------------------------------------------------------------------------

Amortized intangible assets:

Trade names .......................... $ 29,343 $ (425) $ 28,918 $ 3,854 $ (35) $ 3,819

Franchise agreements ................. 22,831 (2,061) 20,770 6,115 (1,482) 4,633

Non-compete agreements ............... 5,132 (4,760) 372 5,029 (4,192) 837

Other ................................ 6,275 (1,428) 4,847 2,525 (960) 1,565

---------------------------------------------------------------------------------------------------------------------

$ 63,581 $ (8,674) $ 54,907 $ 17,523 $ (6,669) $ 10,854

=====================================================================================================================

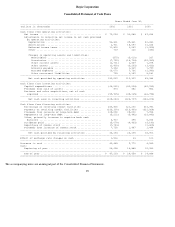

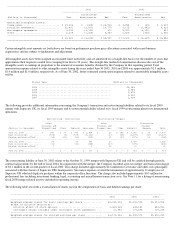

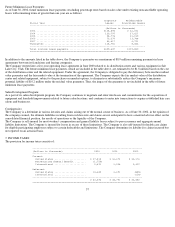

Fiscal Year (Dollars in thousands)

--------------------------------------------------------------------------------

2003 .................................................... $3,183

2004 .................................................... 2,948

2005 .................................................... 2,678

2006 .................................................... 2,634

2007 .................................................... 2,634

Restructuring--International Restructuring--Mergers

-------------------------------------------------------------------------------

Salon Salon Transaction

Closures and Closures and Charges--

(Dollars in thousands) Dispositions Other Subtotal Severance Dispositions Other Subtotal Mergers Total

------------------------------------------------------------------------------------------------------------------------------------

June 30, 2000 ............. $ 583 $ 67 $ 650 $ 2,824 $ 23 $ 145 $ 2,992 $ 35 $ 3,677

Cash utilization .......... (534) (5) (539) (1,616) (27) (48) (1,691) (47) (2,277)

Foreign currency effect ... (19) (62) (81) (209) 31 (97) (275) 12 (344)

------------------------------------------------------------------------------------------------------------------------------------

June 30, 2001 ............. 30 30 999 27 1,026 1,056

Cash utilization .......... (31) (31) (348) (27) (375) (406)

Foreign currency effect ... 1 1 62 62 63

------------------------------------------------------------------------------------------------------------------------------------

June 30, 2002 ............. $ -- $ -- $ -- $ 713 $ -- $ -- $ 713 $ -- $ 713

====================================================================================================================================

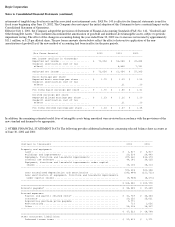

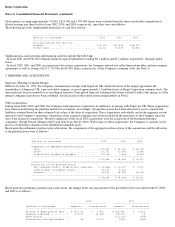

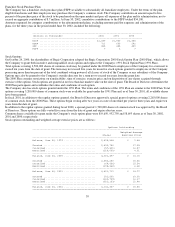

----------------------------------------------------------------------------------------------------------------

2002 2001 2000

----------------------------------------------------------------------------------------------------------------

Weighted average shares for basic earnings per share .............. 42,283,308 41,220,925 40,611,928

Effect of dilutive securities:

Dilutive effect of stock options ................................ 1,867,038 638,153 880,056

Contingent shares issuable under contingent stock agreements .... 21,986 171,895 110,298

----------------------------------------------------------------------------------------------------------------

Weighted average shares for diluted earnings per share ............ 44,172,332 42,030,973 41,602,282

================================================================================================================