Supercuts 2002 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2002 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.EXHIBIT 1(a)

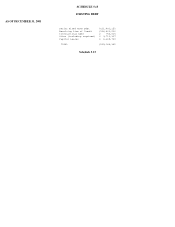

[FORM OF SERIES A NOTE]

REGIS CORPORATION

6.73% SENIOR NOTE, SERIES A

DUE MARCH 15, 2009

called the "Company"), a corporation organized and existing under the laws of the State of Minnesota, promises to pay to [ ], or registered

assigns, the principal sum of $[ ] on March 15, 2009, with interest (computed on the basis of a 360-day year of twelve 30-day months) (a) on

the unpaid balance thereof at the rate of 6.73% per annum from the date hereof, payable semiannually, on March 15 and September 15 in each

year, commencing with the March or September next succeeding the date hereof (except that no interest payment shall be made on March 15,

2002), until the principal hereof shall have become due and payable, and (b) to the extent permitted by law on any overdue payment (including

any overdue prepayment) of principal, any overdue payment of interest and any overdue payment of any Make-Whole Amount (as defined in

the Note Purchase Agreement referred to below), payable semiannually as aforesaid (or, at the option of the registered holder hereof, on

demand), at a rate per annum from time to time equal to the greater of (i) 8.73% or (ii) 2% over the rate of interest publicly announced by Bank

of America from time to time in Chicago, Illinois as its "base" or "prime" rate.

Payments of principal of, interest on and any Make-Whole Amount with respect to this Note are to be made in lawful money of the United

States of America at the principal office of Bank of America in Chicago, Illinois or at such other place as the Company shall have designated

by written notice to the holder of this Note as provided in the Note Purchase Agreement referred to below.

This Note is one of a series of Senior Notes (herein called the "Notes") issued pursuant to a Note Purchase Agreement dated as of March 1,

2002 (as from time to time amended, the "Note Purchase Agreement"), between the Company and the respective Purchasers named therein and

is entitled to the benefits thereof. Each holder of this Note will be deemed, by its acceptance hereof, (i) to have agreed to the confidentiality

provisions set forth in

Section 20 of the Note Purchase Agreement and (ii) to have made the representation set forth in Section 6.2 of the Note Purchase Agreement.

Exhibit 1(a)

No. A-[_____] [Date]

$[_______] PPN: 758932 D# 1

FOR VALUE RECEIVED, the undersigned, REGIS CORPORATION (herein