Supercuts 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

26

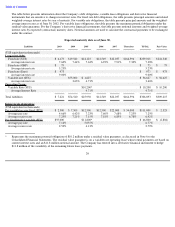

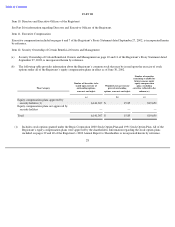

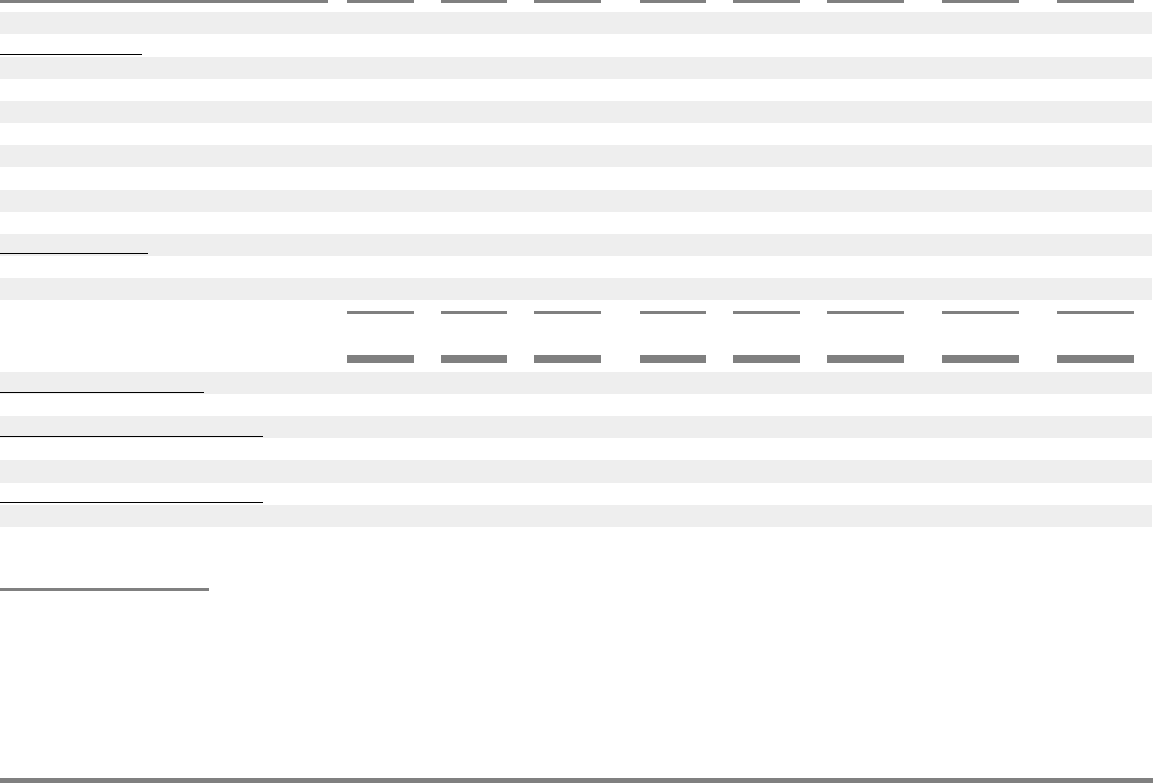

The table below presents information about the Company’s debt obligations, variable lease obligations and derivative financial

instruments that are sensitive to changes in interest rates. For fixed rate debt obligations, the table presents principal amounts and related

weighted-average interest rates by year of maturity. For variable rate obligations, the table presents principal amounts and the weighted-

average interest rates as of June 30, 2002. For variable lease obligations, the table presents the maximum potential obligation under the

residual value guarantee. For the Company’s derivative financial instruments, the table presents notional amounts and weighted-average

interest rates by expected (contractual) maturity dates. Notional amounts are used to calculate the contractual payments to be exchanged

under the contract.

Expected maturity date as of June 30,

Liabilities 2003 2004 2005 2006 2007

Thereafter

TOTAL

Fair Value

(US$ equivalent in thousands)

Long

-

term debt:

Fixed rate ($US)

$

6,173

$

19,540

$

14,123

$

12,549

$

22,037

$

164,596

$

239,018

$

241,340

Average interest rate

7.60

%

7.44

%

7.63

%

6.92

%

7.91

%

7.30

%

7.38

%

Fixed rate (GBP)

$

75

$

75

$

75

Average interest rate

5.23

%

5.23

%

Fixed rate (Euro)

$

973

$

973

$

973

Average interest rate

9.00

%

9.00

%

Variable rate ($US)

$

55,000

$

1,627

$

56,627

$

56,627

Average interest rate

3.63

%

4.71

%

3.66

%

Operating Lease:

Variable Rate ($US)

$

10,200

*

$

10,200

$

10,200

Average Interest Rate

4.71

%

4.71

%

Total liabilities

$

7,221

$

74,540

$

25,950

$

12,549

$

22,037

$

164,596

$

306,893

$

309,215

Interest rate derivatives

(US$ equivalent in thousands)

Pay variable/receive fixed ($US)

$

2,500

$

7,500

$

12,500

$

12,500

$

22,000

$

54,000

$

111,000

$

2,323

Average pay rate

4.66

%

6.42

%

7.23

%

7.60

%

7.68

%

7.23

%

7.25

%

Average receive rate

7.25

%

7.21

%

7.15

%

7.18

%

6.85

%

6.78

%

6.92

%

Pay fixed/receive variable ($US)

$

55,000

$

11,800

*

$

66,800

$

(2,804

)

Average pay rate

7.14

%

5.055

%

6.77

%

Average receive rate

2.50

%

4.13

%

2.79

%

*

Represents the maximum potential obligation of $10.2 million under a residual value guarantee, as discussed in Note 6 to the

Consolidated Financial Statements. The residual value guarantee is on a variable rate operating lease whose rental payments are based on

current interest rates and an $11.8 million notional amount. The Company has entered into a derivative financial instrument to hedge

$11.8 million of the variability of the remaining future lease payments.