Supercuts 2002 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2002 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Regis Corporation

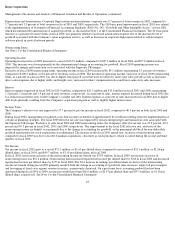

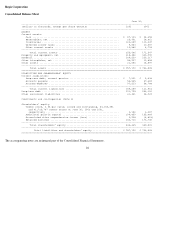

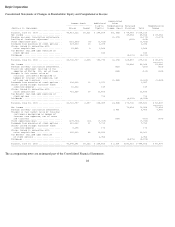

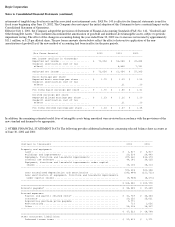

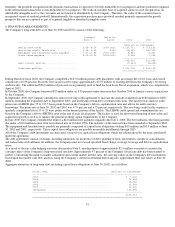

Consolidated Statements of Changes in Shareholders' Equity and Comprehensive Income

The accompanying notes are an integral part of the Consolidated Financial Statements.

28

Accumulated

Common Stock Additional Other

--------------------- Paid-In Comprehensive Retained Comprehensive

(Dollars in thousands) Shares Amount Capital Income (Loss) Earnings Total Income

-------------------------------------------------------------------------------------------------------------------------------

Balance, June 30, 1999 ................... 40,419,122 $2,021 $ 148,504 $(1,095) $ 84,789 $ 234,219

Net income ............................... 49,654 49,654 $ 49,654

Foreign currency translation adjustments.. (1,179) (1,179) (1,179)

Pooling of interests adjustment .......... (665) (665)

Stock repurchase plan .................... (115,000) (6) (1,419) (1,425)

Proceeds from exercise of stock options .. 329,000 16 1,478 1,494

Shares issued in connection with

salon acquisitions ..................... 69,585 4 1,584 1,588

Tax benefit realized upon exercise of

stock options .......................... 646 646

Dividends ................................ (5,191) (5,191)

------------------------------------------------------------------------------------------------------------------------------

Balance, June 30, 2000 ................... 40,702,707 2,035 150,793 (2,274) 128,587 279,141 $ 48,475

========

Net income ............................... 53,088 53,088 53,088

Foreign currency translation adjustments.. (921) (921) (921)

Transition adjustment relating to the

adoption of FAS No. 133, net of taxes .. (160) (160) (160)

Changes in fair market value of

financial instruments designated as

hedges of interest rate exposure, net

of taxes and transfers ................. (1,460) (1,460) (1,460)

Proceeds from exercise of stock options .. 298,362 16 1,971 1,987

Shares issued through franchise stock

incentive program ...................... 10,662 149 149

Shares issued in connection with

salon acquisitions ..................... 715,056 36 11,860 11,896

Tax benefit realized upon exercise of

stock options .......................... 716 716

Dividends ................................ (4,935) (4,935)

------------------------------------------------------------------------------------------------------------------------------

Balance, June 30, 2001 ................... 41,726,787 2,087 165,489 (4,815) 176,740 339,501 $ 50,547

========

Net income ............................... 72,054 72,054 72,054

Foreign currency translation adjustments.. 9,460 9,460 9,460

Changes in fair market value of financial

instruments designated as hedges of

interest rate exposure, net of taxes

and transfers .......................... (707) (707) (707)

Stock repurchase plan .................... (278,700) (14) (7,729) (7,743)

Proceeds from exercise of stock options .. 621,163 31 7,719 7,750

Shares issued through franchise stock

incentive program ...................... 8,198 173 173

Shares issued in connection with

salon acquisitions ..................... 962,933 48 26,253 26,301

Tax benefit realized upon exercise

of stock options ....................... 2,954 2,954

Dividends ................................ (5,078) (5,078)

------------------------------------------------------------------------------------------------------------------------------

Balance, June 30, 2002 ................... 43,040,381 $2,152 $ 194,859 $ 3,938 $243,716 $ 444,665 $ 80,807

==============================================================================================================================