Supercuts 2002 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2002 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Regis Corporation

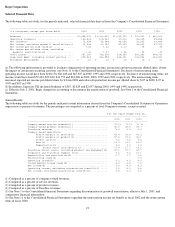

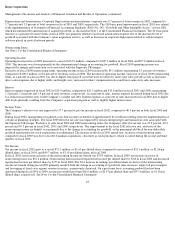

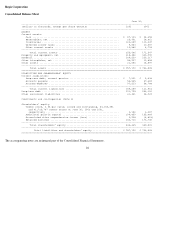

Selected Financial Data

The following table sets forth, for the periods indicated, selected financial data derived from the Company's Consolidated Financial Statements.

(a) The following information is provided to facilitate comparisons of operating income, net income and net income per diluted share, absent

the impact of certain non-recurring activities (see Note 11 to the Consolidated Financial Statements). Exclusive of nonrecurring items,

operating income would have been $100,156, $81,468 and $67,837 in 2000, 1999 and 1998, respectively. Exclusive of nonrecurring items, net

income would have been $70,304, $52,380, $43,759 and $35,006 in 2002, 2000, 1999 and 1998, respectively. The nonrecurring items

increased reported net income per diluted share by $.04 in 2002 and reduced reported net income per diluted share by $.07 in 2000, $.27 in

1999 and $.03 in 1998.

(b) In addition, Supercuts UK declared dividends of $367, $2,829 and $2,057 during 2000, 1999 and 1998, respectively.

(c) Effective July 1, 2001, Regis changed its accounting to discontinue the amortization of goodwill. See Note 1 to the Consolidated Financial

Statements.

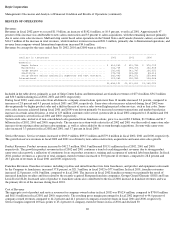

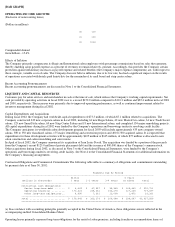

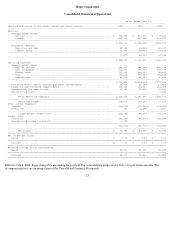

Annual Results

The following table sets forth for the periods indicated certain information derived from the Company's Consolidated Statement of Operations

expressed as a percent of revenues. The percentages are computed as a percent of total Company revenues, except as noted.

(1) Computed as a percent of company-owned revenues.

(2) Computed as a percent of service revenues.

(3) Computed as a percent of product revenues.

(4) Computed as a percent of franchise revenues.

(5) See Note 1 to the Consolidated Financial Statements regarding discontinuation of goodwill amortization, effective July 1, 2001, and

comparative financial information.

(6) See Note 11 to the Consolidated Financial Statements regarding the nonrecurring income tax benefit in fiscal 2002 and the nonrecurring

items in fiscal 2000.

18

-----------------------------------------------------------------------------------------------------------------

(In thousands, except per share data) 2002 2001 2000 1999 1998

-----------------------------------------------------------------------------------------------------------------

Revenues ..................................... $1,454,191 $1,311,621 $1,142,993 $ 991,900 $ 860,620

Operating income(a) .......................... 133,864 109,281 97,216 65,335 65,858

Net income(a) ................................ 72,054 53,088 49,654 32,205 33,894

Net income, excluding goodwill amortization(c) 72,054 61,954 57,395 38,432 37,975

Net income per diluted share(a) .............. 1.63 1.26 1.19 .78 .83

Net income per diluted share, excluding

goodwill amortization(c) ................... 1.63 1.47 1.38 .93 .93

Total assets ................................. 957,190 736,505 628,355 500,582 408,733

Long-term debt, including current portion .... 299,016 261,558 234,601 166,986 126,960

Dividends declared(b) ........................ $ .12 $ .12 $ .12 $ .10 $ .06

For the Years Ended June 30,

---------------------------------------------------------------------------------------

2002 2001 2000

---------------------------------------------------------------------------------------

Company-owned service revenues(1) ........................ 70.0% 71.2% 71.3%

Company-owned product revenues(1) ........................ 30.0 28.8 28.7

Franchise revenues ....................................... 5.3 4.3 4.4

Company-owned operations:

Profit margins on service(2) ....................... 43.4 43.0 43.3

Profit margins on product(3) ....................... 47.6 47.0 46.1

Direct salon(1) .................................... 9.0 9.0 8.5

Rent(1) ............................................ 14.3 14.1 14.0

Depreciation(1) .................................... 3.5 3.4 3.4

Direct salon contribution(1) .................. 17.8 17.7 18.2

Franchise direct costs, including product and equipment(4) 49.1 37.7 34.7

Corporate and franchise support costs .................... 9.6 9.6 10.1

Depreciation and amortization(5) ......................... 0.7 1.7 1.5

Nonrecurring items(6) .................................... 0.3

Operating income(5) ...................................... 9.2 8.3 8.5

Income before income taxes(5) ............................ 8.0 6.8 7.3

Net income(5) ............................................ 5.0 4.0 4.3

Operating income, excluding nonrecurring items(5)(6) ..... 9.2 8.3 8.8

Net income, excluding nonrecurring items(5)(6) ........... 4.8 4.0 4.6