Supercuts 2002 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2002 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Regis Corporation

Notes to Consolidated Financial Statements

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES:

Business Description:

Regis Corporation (the Company) owns, operates and franchises hairstyling and hair care salons throughout the United States, the United

Kingdom, France, Canada, Puerto Rico and several other countries. Substantially all of the hairstyling and hair care salons owned and operated

by the Company in the United States are located in leased space in enclosed mall shopping centers or strip shopping centers. Franchised salons

throughout the United States are primarily located in strip shopping centers. The company-owned and franchised salons in the United

Kingdom, France and several other countries are owned and operated in malls, leading department stores, mass merchants and high-street

locations.

At June 30, 2002, approximately five percent of the Company's outstanding common stock is owned by Curtis Squire, Inc. (CSI), which is a

holding company controlled by the Chairman of the Board of Directors of the Company, and approximately four percent is owned by

management and the Company's benefit plans.

Consolidation:

The Consolidated Financial Statements include the accounts of the Company and all of its wholly-owned subsidiaries. In consolidation, all

material intercompany accounts and transactions are eliminated.

Use of Estimates:

The preparation of Consolidated Financial Statements in conformity with accounting principles generally accepted in the United States of

America requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during

the reporting period. The more significant estimates made by management are the estimated useful lives and net realizable values of long-lived

assets, the fair value of assets acquired in business combinations and various commitments and contingencies. Actual results could differ from

those estimates.

Foreign Currency Translation:

Financial position, results of operations and cash flows of the Company's international subsidiaries are measured using local currency as the

functional currency. Assets and liabilities of these subsidiaries are translated at the exchange rates in effect at each fiscal year end. Translation

adjustments arising from the use of differing exchange rates from period to period are included in accumulated other comprehensive income

(loss) within shareholders' equity. Income statement accounts are translated at the average rates of exchange prevailing during the year. The

different exchange rates from period to period impact the amount of reported income from the Company's international operations.

Inventories:

Inventories consist principally of hair care products held either for use in salon services or for sale. Inventories are stated at the lower of cost or

market with cost determined on a weighted average basis, which approximates the first-in, first-out method.

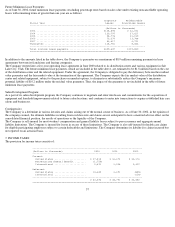

Property and Equipment:

Property and equipment are carried at cost, less accumulated depreciation and amortization. Depreciation and amortization of property and

equipment are computed on the straight-line method over estimated useful asset lives (30 to 39 years for buildings and improvements and five

to ten years for equipment, furniture, software and leasehold improvements).

The Company capitalizes both internal and external costs of developing or obtaining computer software for internal use. Costs incurred to

develop internal-use software during the application development stage are capitalized, while data conversion, training and maintenance costs

associated with internal-use software are expensed as incurred. As of June 30, 2002 and 2001, the net book value of capitalized computer

software costs was $23.2 million and $24.1 million, respectively. Amortization expense related to capitalized computer software was $5.5

million in fiscal 2002, $4.8 million in fiscal 2001 and $3.3 million in fiscal 2000, which has been determined based on an estimated useful life

of five or seven years.

Expenditures for maintenance and repairs and minor renewals and betterments which do not improve or extend the life of the respective assets

are expensed. All other expenditures for renewals and betterments are capitalized. The assets and related depreciation/amortization accounts are

adjusted for property retirements and disposals with the resulting gain or loss included in operations. Fully depreciated/amortized assets remain

in the accounts until retired from service.

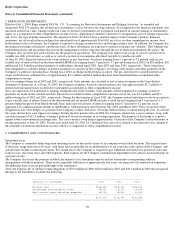

Goodwill:

Prior to July 1, 2001, goodwill recorded in connection with the fiscal 1989 purchase of the publicly held minority interest in the Company, and

acquisitions of business operations in which the Company had not previously been involved, was amortized on a straight-line basis over 40

years. Goodwill recorded in connection with acquisitions which expanded the Company's existing business activities (acquisitions of salon

sites) was amortized on a straight-line basis, generally over 20 years. Effective July 1, 2001, the Company ceased all amortization of goodwill

balances. See discussion under "Recent Accounting Pronouncements."

30