Supercuts 2002 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2002 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Regis Corporation

Notes to Consolidated Financial Statements (continued)

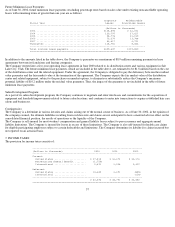

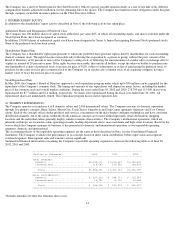

Included in the table above are franchise revenues of $77.6 million, $56.3 million and $50.3 million during fiscal 2002, 2001 and 2000,

respectively, as part of consolidated revenues. The expenses associated with the Company's franchising activities are included in franchise

direct costs, and corporate and franchise support costs within the Consolidated Statement of Operations, as described in Note 1 to the

Consolidated Financial Statements. The current year presentation has been changed to reflect total revenues and salon contribution including

franchise revenues and direct costs in order to show total segment operating results. In fiscal 2001, only company-owned operations were

reflected in this disclosure.

Corporate assets detailed above are primarily comprised of property and equipment associated with the Company's headquarters and

distribution centers, corporate cash, inventories located at corporate distribution centers, deferred income taxes, franchise receivables and other

corporate assets.

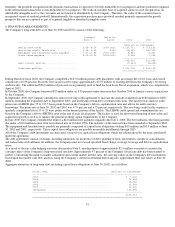

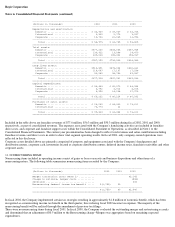

11. NONRECURRING ITEMS:

Nonrecurring items included in operating income consist of gains or losses on assets and business dispositions and other items of a

nonrecurring nature. The following table summarizes nonrecurring items recorded by the Company:

In fiscal 2002, the Company implemented certain tax strategies resulting in approximately $1.8 million of economic benefit, which has been

recognized as a nonrecurring income tax benefit in the third quarter, thus reducing fiscal 2002 income tax expense. The majority of the

nonrecurring benefit will be realized through the amendment of previous tax filings.

There were no nonrecurring items during fiscal 2001. In fiscal 2000, the Company evaluated the outstanding merger and restructuring accruals

and determined that an adjustment of $0.5 million to the Restructuring charge--Mergers was appropriate based on remaining expected

expenditures.

--------------------------------------------------------------------------------

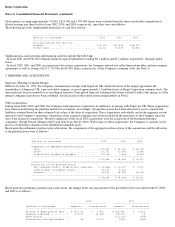

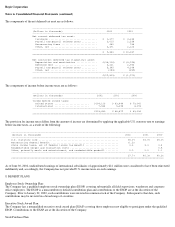

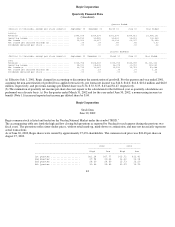

(Dollars in thousands) 2002 2001 2000

--------------------------------------------------------------------------------

Depreciation and amortization:

Domestic ............................. $ 44,949 $ 39,947 $ 33,735

International ........................ 3,320 2,773 3,097

Corporate ............................ 10,706 22,065 16,993

--------------------------------------------------------------------------------

Total .............................. $ 58,975 $ 64,785 $ 53,825

================================================================================

Total assets:

Domestic ............................. $577,230 $538,055 $457,948

International ........................ 130,922 13,048 14,470

Corporate ............................ 249,038 185,402 155,937

--------------------------------------------------------------------------------

Total .............................. $957,190 $736,505 $628,355

================================================================================

Long-lived assets:

Domestic ............................. $510,591 $475,008 $402,631

International ........................ 114,047 17,197 17,538

Corporate ............................ 53,280 55,756 49,087

--------------------------------------------------------------------------------

Total .............................. $677,918 $547,961 $469,256

================================================================================

Capital expenditures:

Domestic ............................. $ 54,444 $ 62,072 $ 48,944

International ........................ 4,792 3,914 4,015

Corporate ............................ 6,996 14,238 27,973

--------------------------------------------------------------------------------

Total .............................. $ 66,232 $ 80,224 $ 80,932

================================================================================

Purchases of salon assets:

Domestic ............................. $ 26,060 $ 64,422 $ 73,611

International ........................ 73,774 22

--------------------------------------------------------------------------------

Total .............................. $ 99,834 $ 64,444 $ 73,611

================================================================================

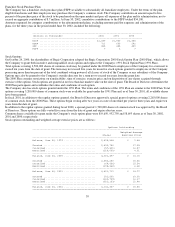

--------------------------------------------------------------------------------

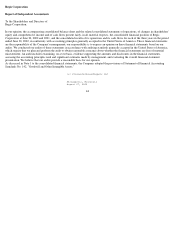

(Dollars in thousands) 2002 2001 2000

--------------------------------------------------------------------------------

Merger transaction costs (Note 2) ........... $3,145

Change in estimate, merger costs ............ (548)

Severance ................................... 343

Nonrecurring federal income tax benefit ..... $(1,750) $0

--------------------------------------------------------------------------------

$(1,750) $0 $2,940

================================================================================