Supercuts 2002 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2002 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Regis Corporation

Management's Discussion and Analysis of Financial Condition and Results of Operations

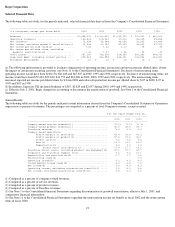

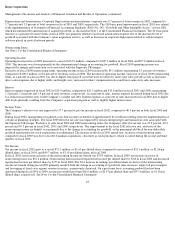

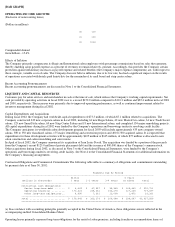

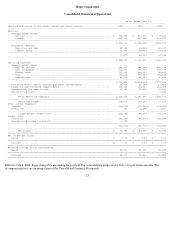

[BAR GRAPH]

EBITDA

(Exclusive of nonrecurring

items in prior years)

(Dollars in millions)

Compounded Annual

Growth Rate - 11.5%

SUMMARY

Regis Corporation, based in Minneapolis, Minnesota, is the world's largest owner, operator, franchisor and acquirer of hair and retail product

salons. The Regis worldwide operations include 8,684 salons at June 30, 2002 operating in two reportable segments: domestic and

international. Each of the Company's concepts have generally similar products and services. The Company is organized to manage its

operations based on geographical location. The Company's domestic segment includes 6,618 salons, including 2,224 franchised salons,

operating primarily under the trade names of Regis Salons, MasterCuts, Trade Secret, SmartStyle, Supercuts and Cost Cutters. The Company's

international operations include 2,066 salons, including 1,684 franchised salons, located throughout Europe, primarily in the United Kingdom,

France, Italy and Spain. The Company has approximately 43,000 employees worldwide.

CRITICAL ACCOUNTING POLICIES

The preparation of Consolidated Financial Statements in conformity with accounting principles generally accepted in the United States of

America requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during

the reporting period. Management bases these estimates on historical experience and other assumptions believed to be reasonable under the

circumstances. However, actual results could differ from these estimates.

Management believes the Company's critical accounting policies and areas that require more significant judgments and estimates used in the

preparation of its Consolidated Financial Statements to be:

- useful lives assigned to long-lived and intangible assets;

- recoverability of long-lived and intangible assets, including goodwill;

- allocation of the purchase price to acquired assets and liabilities, including goodwill and intangibles;

- various commitments and contingencies. Depreciation and amortization are recognized using the straight-line method over the long-lived

assets' estimated useful lives. The Company estimates useful lives based on historical data and industry trends. The Company periodically

reassesses the estimated useful lives of its long-lived and intangible assets. Changes to estimated useful lives would impact the amount of

depreciation and amortization expense recorded in earnings and potentially the need to record an impairment charge. The Company reviews

long-lived and intangible assets, including goodwill, for impairment annually, or at any time events or circumstances indicate that the carrying

value of such assets may not be fully recoverable. For long-lived assets and amortizable intangible assets, an impairment is evaluated based on

the sum of undiscounted estimated future cash flows expected to result from use of the assets compared to its carrying value. The Company

generally considers its brands to be reporting units when it tests for goodwill impairment because that is where the Company believes goodwill

naturally resides. If an impairment is recognized, the carrying value of the impaired asset is reduced to its fair value based on discounted

estimated future cash flows. For goodwill, an impairment is evaluated based on the fair value of the concept to which the goodwill relates. The

Company makes numerous acquisitions that are recorded using the purchase method of accounting. Accordingly, the purchase prices are

allocated to assets acquired, including intangible assets, and liabilities assumed based on their estimated fair values at the dates of acquisition.

Fair value is estimated based on the amount for which the asset or liability could be bought or sold in a current transaction between willing

parties. In the normal course of business, the Company must make continuing estimates of potential future loss accruals related to legal, tax,

self-insurance accruals and uncollectible accounts. These accruals require the use of management's judgment on the outcome of various issues.

Management's estimates for these items are based on the best available evidence, but due to changes in facts and circumstances, the ultimate

outcomes of these accruals could be different than management estimates.

19

00 156

01 175

02 $194