Supercuts 2002 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2002 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Regis Corporation

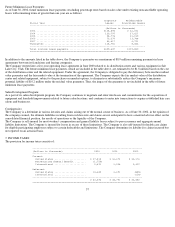

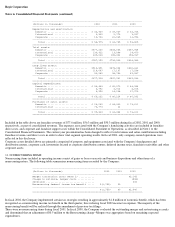

Notes to Consolidated Financial Statements (continued)

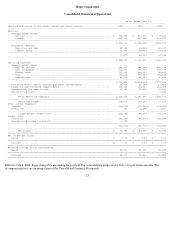

Stock options covering approximately 55,000, 2,819,000 and 1,070,000 shares were excluded from the shares used in the computation of

diluted earnings per share for fiscal year 2002, 2001 and 2000, respectively, since they were anti-dilutive.

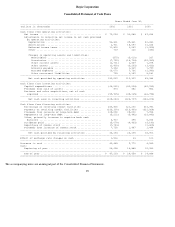

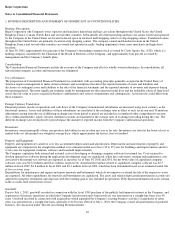

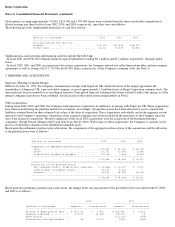

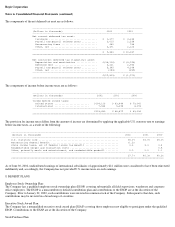

The following provides supplemental disclosures of cash flow activity:

Significant non-cash investing and financing activities include the following:

- In fiscal 2001 and 2000, the Company financed capital expenditures totaling $0.1 million and $2.3 million, respectively, through capital

leases.

- In fiscal 2002, 2001 and 2000, in connection with various acquisitions, the Company entered into seller-financed payables and non-compete

agreements as well as issuing 962,933, 715,056 and 69,585 shares, respectively, of the Company's common stock (see Note 3).

3. MERGERS AND ACQUISITIONS:

Supercuts (Holdings) Limited Merger:

Effective October 31, 1999, the Company consummated a merger with Supercuts UK. Under the terms of the merger agreement, the

shareholders of Supercuts UK, a privately held company, received approximately 1.8 million shares of Regis Corporation common stock. The

transaction has been accounted for as a pooling-of-interests. Prior period financial statements have been restated to reflect this merger as if the

merged companies had always been combined. See discussion of the related restructuring liability in Note 2.

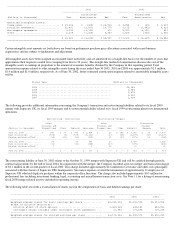

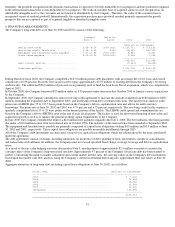

Other Acquisitions:

During fiscal 2002, 2001 and 2000, the Company made numerous acquisitions in addition to its merger with Supercuts UK. These acquisitions

have been recorded using the purchase method of accounting. Accordingly, the purchase prices have been allocated to assets acquired and

liabilities assumed based on their estimated fair values at the dates of acquisition. These acquisitions individually and in the aggregate are not

material to the Company's operations. Operations of the acquired companies have been included in the operations of the Company since the

date of the respective acquisition. The most significant of the fiscal 2002 acquisitions were the acquisition of the European franchise

companies, Groupe Gerard Glemain (GGG) and Jean Louis David (JLD). With respect to these acquisitions, the Company is currently in the

process of obtaining valuations of the identifiable intangible assets.

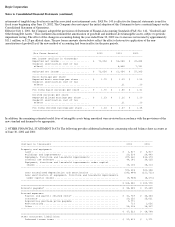

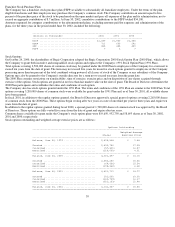

Based upon the preliminary purchase price allocations, the components of the aggregate purchase prices of the acquisitions and the allocation

of the purchase price were as follows:

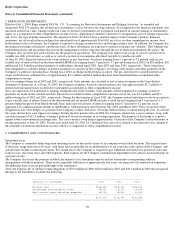

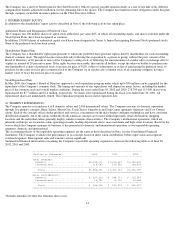

Based upon the preliminary purchase price allocations, the change in the carrying amount of the goodwill for the years ended June 30, 2002

and 2001 is as follows:

--------------------------------------------------------------------------------

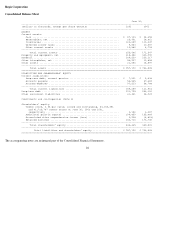

(Dollars in thousands) 2002 2001 2000

--------------------------------------------------------------------------------

Cash paid during the year for:

Interest .................................... $17,609 $20,534 $14,997

Income taxes ................................ 14,621 37,447 36,866

----------------------------------------------------------------------------------

(Dollars in thousands) 2002 2001 2000

----------------------------------------------------------------------------------

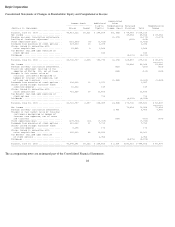

Components of aggregate purchase price:

Cash ......................................... $ 59,925 $ 45,165 $ 66,798

Stock ........................................ 26,301 11,896 1,588

Liabilities assumed or payable ............... 13,608 7,383 5,225

----------------------------------------------------------------------------------

$ 99,834 $ 64,444 $ 73,611

==================================================================================

Allocation of the purchase price:

Net tangible assets (liabilities) acquired ... $ (4,486) $ 11,677 $ 7,576

Identifiable intangible assets ............... 41,181 8,672 --

Goodwill ..................................... 63,139 44,095 66,035

----------------------------------------------------------------------------------

$ 99,834 $ 64,444 $ 73,611

==================================================================================

2002 2001

-------------------------- --------------------------

(Dollars in thousands) Domestic International Domestic International

------------------------------------------------------------------------------------------

Balance at beginning of year ... $ 230,716 $ 5,401 $ 200,036 $ 6,361

Goodwill acquired .............. 21,297 41,842 44,076 19

Amortization ................... (13,112) (596)

Translation rate adjustments ... 42 5,231 (284) (383)