Supercuts 2002 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2002 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Regis Corporation

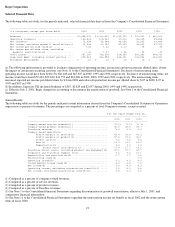

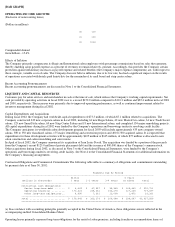

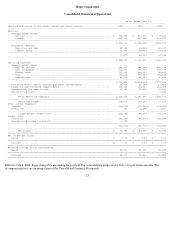

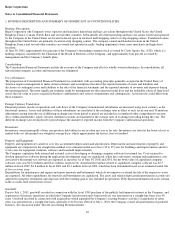

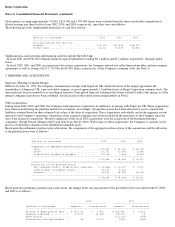

Consolidated Statement of Operations

Effective July 1, 2001, Regis changed its accounting for goodwill. For comparability purposes, see Note 1 for pro forma amounts. The

accompanying notes are an integral part of the Consolidated Financial Statements.

27

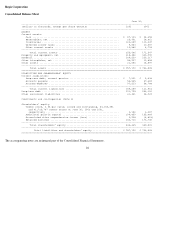

Years Ended June 30,

---------------------------------------------------------------------------------------------------------------------------

(Dollars and shares in thousands, except per share amounts) 2002 2001 2000

---------------------------------------------------------------------------------------------------------------------------

Revenues:

Company-owned salons:

Service ................................................................. $ 963,884 $ 893,472 $ 779,604

Product ................................................................. 412,728 361,858 313,125

---------------------------------------------------------------------------------------------------------------------------

1,376,612 1,255,330 1,092,729

Franchise revenues:

Royalties and fees ...................................................... 50,745 38,230 36,157

Product sales ........................................................... 26,834 18,061 14,107

---------------------------------------------------------------------------------------------------------------------------

77,579 56,291 50,264

---------------------------------------------------------------------------------------------------------------------------

1,454,191 1,311,621 1,142,993

Operating expenses:

Company-owned salons:

Cost of service ......................................................... 546,027 508,981 442,198

Cost of product ......................................................... 216,373 191,796 168,787

Direct salon ............................................................ 123,915 112,667 92,841

Rent .................................................................... 197,269 176,947 152,685

Depreciation ............................................................ 48,269 42,720 36,832

---------------------------------------------------------------------------------------------------------------------------

1,131,853 1,033,111 893,343

Franchise direct costs, including product and equipment .................... 38,114 21,237 17,443

Corporate and franchise support costs ...................................... 139,654 125,927 115,058

Depreciation and amortization .............................................. 10,706 22,065 16,993

Nonrecurring items ......................................................... 2,940

---------------------------------------------------------------------------------------------------------------------------

Total operating expenses .............................................. 1,320,327 1,202,340 1,045,777

---------------------------------------------------------------------------------------------------------------------------

Operating income ...................................................... 133,864 109,281 97,216

Other income (expense):

Interest ................................................................... (19,010) (21,487) (15,839)

Other, net ................................................................. 796 1,085 1,857

---------------------------------------------------------------------------------------------------------------------------

Income before income taxes ............................................ 115,650 88,879 83,234

Income taxes:

Provision .................................................................. (45,346) (35,791) (33,580)

Nonrecurring income tax benefit ............................................ 1,750

---------------------------------------------------------------------------------------------------------------------------

(43,596) (35,791) (33,580)

---------------------------------------------------------------------------------------------------------------------------

Net income ............................................................ $ 72,054 $ 53,088 $ 49,654

===========================================================================================================================

Net income per share:

Basic ...................................................................... $ 1.70 $ 1.29 $ 1.22

===========================================================================================================================

Diluted .................................................................... $ 1.63 $ 1.26 $ 1.19

===========================================================================================================================

Weighted average shares outstanding:

Basic ...................................................................... 42,283 41,221 40,612

===========================================================================================================================

Diluted .................................................................... 44,172 42,031 41,602

===========================================================================================================================