Supercuts 2002 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2002 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Regis Corporation

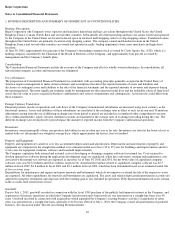

Notes to Consolidated Financial Statements (continued)

retirement of tangible long-lived assets and the associated asset retirement costs. FAS No. 143 is effective for financial statements issued for

fiscal years beginning after June 15, 2002. The Company does not expect the initial adoption of this Statement to have a material impact on the

Consolidated Statement of Operations.

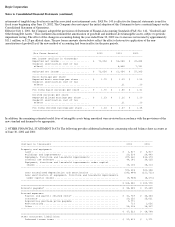

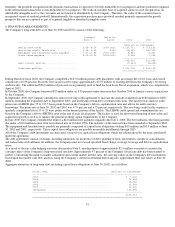

Effective July 1, 2001, the Company adopted the provisions of Statement of Financial Accounting Standards (FAS) No. 142, "Goodwill and

Other Intangible Assets." This statement discontinued the amortization of goodwill and indefinite-lived intangible assets, subject to periodic

impairment testing. The effect of the change in accounting during the year ended June 30, 2002 was to increase net income by approximately

$11.1 million, or $.25 per diluted share. The pro forma amounts shown below reflect the effect of retroactive application of the non-

amortization of goodwill as if the new method of accounting had been in effect in the prior periods.

In addition, the remaining estimated useful lives of intangible assets being amortized were reviewed in accordance with the provisions of the

new standard and deemed to be appropriate.

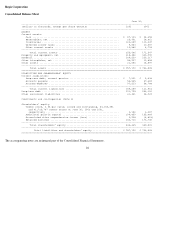

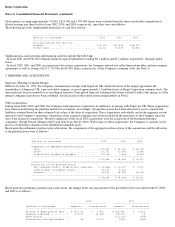

2. OTHER FINANCIAL STATEMENT DATA The following provides additional information concerning selected balance sheet accounts as

of June 30, 2002 and 2001:

--------------------------------------------------------------------------------

(Pro Forma Amounts) 2002 2001 2000

--------------------------------------------------------------------------------

Net income (Dollars in thousands)

Reported net income ..................... $ 72,054 $ 53,088 $ 49,654

Goodwill amortization (net of tax

effect) ................................ 8,866 7,741

--------------------------------------------------------------------------------

Adjusted net income ..................... $ 72,054 $ 61,954 $ 57,395

--------------------------------------------------------------------------------

Basic earnings per share

Reported basic earnings per share ....... $ 1.70 $ 1.29 $ 1.22

Goodwill amortization (net of tax

effect) ................................ .21 .19

--------------------------------------------------------------------------------

Pro forma basic earnings per share ...... $ 1.70 $ 1.50 $ 1.41

--------------------------------------------------------------------------------

Diluted earnings per share

Reported diluted earnings per share ..... $ 1.63 $ 1.26 $ 1.19

Goodwill amortization (net of tax

effect) ................................ .21 .19

--------------------------------------------------------------------------------

Pro forma diluted earnings per share .... $ 1.63 $ 1.47 $ 1.38

================================================================================

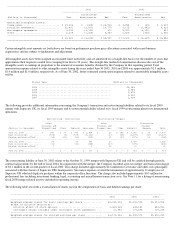

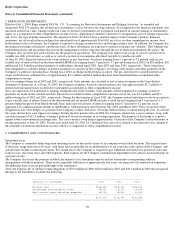

------------------------------------------------------------------------------------------------

(Dollars in thousands) 2002 2001

------------------------------------------------------------------------------------------------

Property and equipment:

Land ............................................................... $ 3,817 $ 3,817

Buildings and improvements ......................................... 29,518 29,449

Equipment, furniture and leasehold improvements .................... 479,662 433,374

Internal use software .............................................. 44,186 39,635

Equipment, furniture and leasehold improvements under capital

leases ............................................................ 15,135 15,113

------------------------------------------------------------------------------------------------

572,318 521,388

Less accumulated depreciation and amortization ..................... (243,888) (211,722)

Less amortization of equipment, furniture and leasehold improvements

under capital leases .............................................. (9,948) (8,676)

------------------------------------------------------------------------------------------------

$ 318,482 $ 300,990

================================================================================================

Accounts payable* ..................................................... $ 54,545 $ 37,689

================================================================================================

Accrued expenses:

Payroll and payroll related costs* ................................. $ 41,769 $ 34,344

Insurance .......................................................... 20,252 15,021

Acquisition purchase price payable ................................. 9,771

Restructuring ...................................................... 713 1,056

Other .............................................................. 25,018 18,367

------------------------------------------------------------------------------------------------

$ 97,523 $ 68,788

================================================================================================

Other noncurrent liabilities:

Deferred income taxes .............................................. $ 29,813 $ 1,971