Singapore Airlines 2001 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2001 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

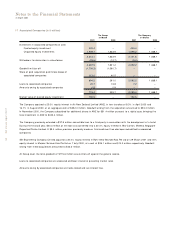

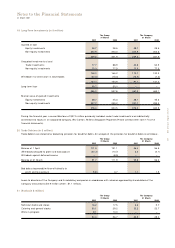

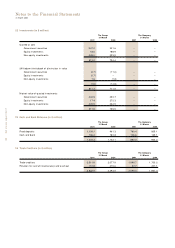

14 Long-Term Liabilities (in $ million) (continued)

The amounts payable by and debts payable to in respect of the subsidiary company at the balance sheet date were as follow:-

Amounts payable by the Debts payable to the

subsidiary company subsidiary company

31 M arch 31 M arch

2001 2000 2001 2000

Not later than two years 38.4 200.9 15.5 4.8

Later than two years but not later than five years 200.0 – 6.9 6.8

238.4 200.9 22.4 11.6

Interest rates on the finance lease commitments are charged at a margin above the London Interbank Offer Rate (LIBOR). These

ranged from 5.77% to 5.96% (1999-2000 : 6.55% to 6.68% ) per annum. These lease commitments are repayable within 10 years.

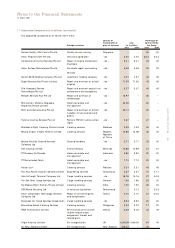

Finance leases

The Company holds 2 B747-400s under finance leases that are due to mature in 2007, without any options for renewal. Both

leases have options for the Company to purchase the aircraft at the end of the lease period of 12.5 years. One of the B747-400

leases has an additional purchase option exercisable in the 10.5th year. The Company intends to hold the aircraft until the end of

the lease periods. Sub-leasing is allowed under the lease agreements. The lease rentals are determined based on a floating rate

linked to LIBOR.

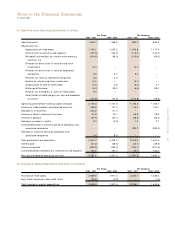

Assuming a rate of 5.77% to 5.96% (1999-2000 : 6.55% to 6.68% ) per annum, representing the 31 March 2001 lease rate, the

future lease payments for these finance leases are as follows:-

The Group The Company

31 M arch 31 M arch

2001 2000 2001 2000

M inimum Repayment M inimum Repayment M inimum Repayment M inimum Repayment

Payments of Principal Payments of Principal payments of Principal Payments of Principal

Within one year 28.4 (2.3) 30.1 (2.6) 28.4 (2.3) 30.1 (2.6)

After one year but not more

than five years 113.2 (9.2) 123.2 (8.0) 113.2 (9.2) 123.2 (8.0)

More than five years 636.2 603.6 638.6 572.4 636.2 603.6 638.6 572.4

Total future lease payments 777.8 592.1 791.9 561.8 777.8 592.1 791.9 561.8

Amounts representing interest (185.7) – (230.1) – (185.7) – (230.1) –

Principal value of long-term

commitments under

finance leases 592.1 592.1 561.8 561.8 592.1 592.1 561.8 561.8

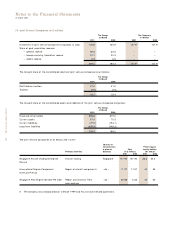

As at 31 March 2001, there are lease obligations amounting to $1,040.0 million (2000 : $1,475.5 million) which are covered by

funds amounting to $1,042.3 million (2000 : $1,512.4 million) placed with financial institutions under defeasance and other

arrangements which have not been included in these financial statements.

The Company continues to remain the primary obligor under the lease agreements and as such, there are contingent liabilities

(secured) of $1,040.0 million (2000 : $1,475.5 million) in respect of unpaid lease commitments.

Operating leases

In addition, the Company holds 13 B747-400s and 6 CFM-56 engines under operating leases with fixed rental rates. The lease

terms range from 4 to 10 years for the B747-400s and 2 to 3.5 years for the CFM-56 engines. In 8 of the B747-400 lease

agreements, the Company holds options to extend the leases for a further maximum period of 2 years. None of the operating

agreements confer to the Company any options to purchase the related aircraft or engines. Sub-leasing is allowed under all the

lease arrangements.

79 SIA annual report 00/01

Notes to the Financial Statements

31 March 2001