Singapore Airlines 2001 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2001 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

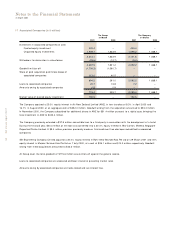

10 Share Capital (in $ million) (continued)

As at 31 March 2001, the unissued ordinary shares under The Singapore Airlines Limited Employee Share Option Plan were as

follows:

(i) 13,562,150 ordinary shares at $15.96 per share exercisable between 28 March 2000 to 27 March 2010.

(ii) 12,106,150 ordinary shares at $17.32 per share exercisable between 3 July 2000 to 2 July 2010.

The Company's ability to operate its existing route network and flight frequency is derived solely from and dependent entirely on

the Air Service Agreements ( " ASAs" ) concluded between the Government of Singapore and the governments of other countries.

ASAs are therefore critical to the Company's operations. In almost all the ASAs, it is a condition that the Company must at all times

be " effectively controlled" and " substantially owned" by Singapore nationals for the tenure of the respective ASAs.

In order to comply with the above requirement, the Company has, in financial year 1999-00, issued one non-tradeable Special

Share of par value $1.00 to the Minister of Finance. The Special Share enjoys all the rights attached to ordinary shares. In addition,

pursuant to Article 3A of the Articles of Association, no resolution may be passed on certain matters without prior written approval

of the Special Member.

The Company has also increased the authorised share capital in financial year 1999-00, by the creation of 3,000,000,000 non-

tradeable redeemable cumulative preference shares of par value $1.00 each which carry full voting rights ( " ASA shares " ). The

ASA shares will be partially paid to $0.01 each at the time of issue. When issued, the ASA shares (partially paid or otherwise) will

carry equal voting rights as those of ordinary shares. The ASA shares will be issued by the Company only when the directors

determine that its operating rights under any of the ASAs are threatened by reason of the nationality of the majority shareholders.

Consequent to the share buyback scheme approved by the shareholders, the Company purchased 30,334,600 (1999-2000 :

32,014,000) ordinary shares during the financial year at an average price of $15.70 (1999-2000 : $15.90) per share, amounting to

a total cost, including brokerage, of $476.0 million (1999-2000 : $509.7 million).

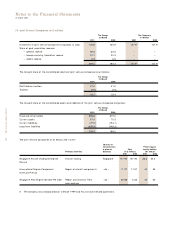

11 Reserves

The distributable reserves of the Company will be available for distribution as dividends subject to the payment of income tax of

approximately $2,518.0 million (2000 : $2,481.4 million). These potential tax payments are substantially covered by $760.9 million

which has been provided in the current and deferred tax account in the balance sheet and an additional $1,800.0 million set aside

in the special non-distributable reserve, as explained in the following paragraph.

Special non-distributable reserve

An amount of $1,800.0 million has been transferred from the general reserve to a special non-distributable reserve to meet

deferred tax liabilities that have not been fully provided for in these financial statements (refer note 13 to the financial statements).

The special non-distributable reserve will be applied when the Group is required to change from its existing policy to providing such

deferred tax.

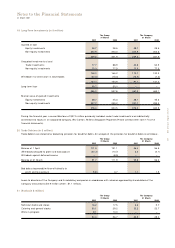

12 Deferred Accounts (in $ million)

The Group The Company

31 M arch 31 M arch

2001 2000 2001 2000

Deferred income on sale and leaseback transactions 530.8 506.7 530.8 506.7

Deferred income on divestments 202.6 202.6 – –

Deferred taxation (note 13) 624.0 457.7 519.8 365.8

1,357.4 1,167.0 1,050.6 872.5

In June 1998, SIA Engineering Company Limited (SIAEC) divested its 51% interest in Eagle Services Asia Private Limited (ESA) to

Pratt & Whitney Holdings LLC (PWHLLC). The profit arising on disposal was $202.6 million.

77 SIA annual report 00/01

Notes to the Financial Statements

31 March 2001