Singapore Airlines 2001 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2001 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

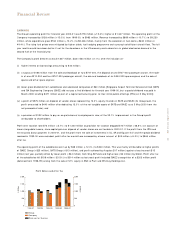

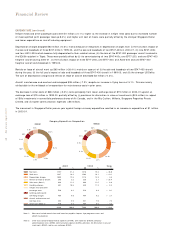

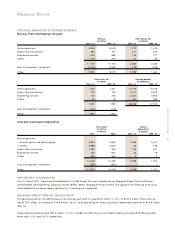

EARNINGS

The Group’s operating profit for financial year 2000-01 was $178 million (+15.2% ) higher at $1,347 million. The operating profit of the

Company increased by $128 million (+15.0% ) from 1999-00, to $983 million. Revenue increased by $889 million (+10.7% ) to $9,230

million, while expenditure grew $760 million (+10.2% ) to $8,246 million, mainly from the escalation in fuel costs (+$630 million or

49.4% ). The rising fuel prices were mitigated by higher yields, fuel hedging programme and a young fuel-efficient aircraft fleet. The full

year results would have been better if not for the slowdown in the US economy and a downturn in global electronics demand in the

second half of the financial year.

The Company’s profit before tax was $1,607 million, down $34 million (-2.1% ) after the inclusion of:-

(i) higher interest on borrowings amounting to $44 million;

(ii) a surplus of $166 million from the sale and leaseback of two B747-400, the disposal of one B747-400 passenger aircraft, the trade-

in of one A310-200 and four B747-300 passenger aircraft, the sale and leaseback of six A340-300 spare engines, and the sale of

spares and other spare engines;

(iii) lower gross dividends from subsidiaries and associated companies of $60 million [Singapore Airport Terminal Services Limited (SATS)

and SIA Engineering Company (SIAEC) did not pay a final dividend for financial year 1999-00, but a special dividend was paid in

March 2000 totalling $371 million as part of a capital restructuring prior to their initial public offerings (IPOs) on 5 May 2000];

(iv) a profit of $575 million on disposal of vendor shares representing 13.0% equity interests in SATS and SIAEC (At Group level, the

profit amounted to $440 million after deducting 13.0% of the net tangible assets of SATS and SIAEC as at 5 May 2000 from the

net proceeds of sale); and

(v) a provision of $132 million to pay an ex-gratia bonus to employees in view of the 33.1% improvement in the Group’s profit

attributable to shareholders.

Profit after taxation rose $73 million (+5.7% ) to $1,340 million as provision for taxation dropped $107 million (-28.6% ) on account of

lower chargeable income, since capital gains on disposal of vendor shares are not taxable in 2000-01. If the profit from the IPOs and

the ex-gratia bonus payment in 2000-01, and the profit from the sale of investments in DL, SR and Equant N.V. and the special dividend

received in 1999-00 were excluded, profit after tax would have increased by a lower amount of $43 million (+5.2% ) to $865 million

after tax.

The operating profit of the subsidiaries went up by $38 million (+12.4% ) to $343 million. This was mainly attributable to higher profits

of SIAEC Group (+$25 million), SATS Group (+$13 million), and profit achieved by Auspice ($17 million) against a loss incurred ($15

million) last year, partially offset by lower profit (-$34 million) from Sing-Bi Funds and higher loss (-$2 million) by SilkAir. Profit after tax

of the subsidiaries fell $158 million (-33.5% ) to $314 million as last year’s profit included SIAEC’s recognition of a $203 million profit

(deferred from 1998-99) arising from the sale of 51% equity in ESA to Pratt and Whitney Holdings LLC.

33 SIA annual report 00/01

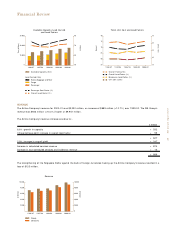

Financial Review

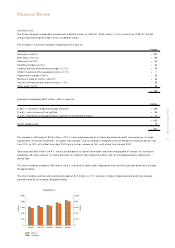

■■■ Group

■■■ Company

■■■ Provision for Taxation

2,000

1,500

1,000

500

0

2,000

1,500

1,000

500

0

Profit Before and After Tax

$ Million

$ Million

1996/97 1997/98 1998/99 1999/00 2000/01