Singapore Airlines 2001 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2001 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39 SIA annual report 00/01

Financial Review

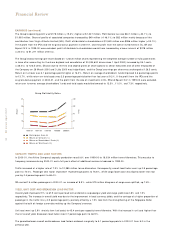

TAXATION

The Company’s provision for taxation in 2000-01 was $268 million, a drop of $107 million (-28.6% ) from 1999-00. This was due to

lower provision for current tax in Singapore as a result of lower chargeable income. Provision for deferred tax amounted to $154 million

for 2000-01 as capital allowances were higher than depreciation charges.

The SIA Group’s provision for taxation was $317 million, up $21 million (+7.0% ) from 1999-00.

DIVIDENDS

The Board of Directors is proposing a total dividend for 2000-01 of 35.0 cents per $1 ordinary share less Singapore income tax. This is

5.0 cents per share higher (+16.7% ) than the total dividend paid for 1999-00. An interim dividend of 15.0 cents per $1 ordinary share

less income tax at 25.5% amounting to $137 million, was paid on 22 November 2000.

The proposed final dividend is 20.0 cents per $1 ordinary share less Singapore income tax at 24.5% . With the proposed final dividend,

the total dividend less Singapore income tax for 2000-01 will amount to $321 million.

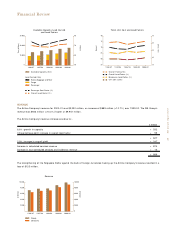

ISSUED SHARE CAPITAL

Under the share buyback programme (which was first approved by shareholders on 11 September 1999, with the mandate renewed at

the Company’s extraordinary meeting on 15 July 2000), the Company made a further purchase of 30,334,600 of its shares between

1 April 2000 and 31 March 2001 at a total cost, including brokerage, of $476 million. The issued share capital of the Company was

reduced by 30,334,600 shares or 2.4% to 1,220,197,622 shares at 31 March 2001. The amount spent so far under the programme as

at 31 March 2001 for 62,348,600 shares totalled $986 million ($510 million up to 31 March 2000 plus $476 million from 1 April 2000

to 31 March 2001), including brokerage but excluding Section 44 tax prepayments of $338 million.

SHARE OPTIONS

On 3 July 2000, the Company made a second grant of share options and 12,258,890 share options were accepted by eligible

employees to subscribe for ordinary shares under the SIA Employee Share Option Plan (the Plan) for the exercise period 3 July 2001

to 2 July 2010. As at 31 March 2001, options to subscribe for 25,668,300 ordinary shares remain outstanding under the Plan.

INVESTM ENT AND GOODWILL

During the year under review, the Company acquired a 25% equity interest in Air New Zealand Limited (ANZ) class B shares, in two

tranches of 8.3% in April 2000 and 16.7% in August 2000, at an aggregate cost of $352 million. Goodwill arising from the acquisition

amounted to $93 million. At Group level, the amount of the goodwill is written off against shareholders’ distributable reserves as

allowed under Statement of Accounting Standard (SAS) 22 on accounting for business combinations issued by Institute of Certified

Public Accountants of Singapore (ICPAS). In November 2000, the Company subscribed additional shares in ANZ for $51 million pursuant

to a rights issue, bringing the total investment in ANZ to $403 million. The share of the unaudited results for the period July to

December 2000 of ANZ has been included in the Group’s results since they have been announced. In future, the Group will incorporate

its share of ANZ’s profits for the full year April (n) to March (n+1) [ where n denotes year] on the basis of its share of ANZ’s results for

the period January to December (n).