Salesforce.com 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

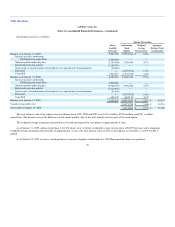

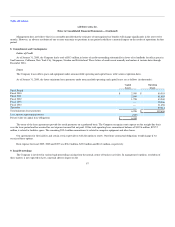

At January 31, 2009, the Company had net operating loss carryforwards for federal income tax purposes of approximately $70.8 million, which expire

in 2023 through 2029, federal research and development tax credits of approximately $10.9 million, which expire in 2020 through 2029 and minimum tax

credits of $1.7 million which do not expire. The Company also has state net operating loss carryforwards of approximately $165.0 million which expire

beginning in 2011, state research and development tax credits of approximately $9.5 million and $1.2 million of state enterprise zone tax credits, which do not

expire.

Utilization of the Company's net operating loss carryforwards may be subject to substantial annual limitation due to the ownership change limitations

provided by the Internal Revenue Code and similar state provisions. Such an annual limitation could result in the expiration of the net operating loss and tax

credit carryforwards before utilization.

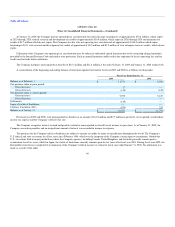

The Company had gross unrecognized tax benefits of $16.5 million and $11.8 million at the end of January 31, 2009 and January 31, 2008 respectively.

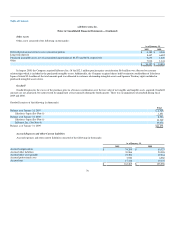

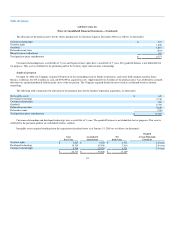

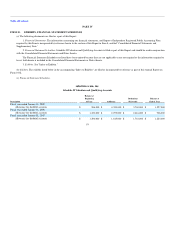

A reconciliation of the beginning and ending balance of total unrecognized tax benefits for fiscal 2009 and 2008 is as follows (in thousands):

Fiscal Year Ended January 31,

2009 2008

Balance as of February 1 $ 11,771 $ 6,542

Tax positions taken in prior period:

Gross increases 17 —

Gross decreases (148) (125)

Tax positions taken in current period:

Gross increases 5,955 5,129

Gross decreases — —

Settlements (149) —

Lapse of statute of limitations — —

Currency translation effect (974) 225

Balance as of January 31 $ 16,472 $ 11,771

For fiscal year 2009 and 2008, total unrecognized tax benefits in an amount of $11.8 million and $7.9 million respectively, if recognized, would reduce

income tax expense and the Company's effective tax rate.

The Company recognizes interest accrued and penalties related to unrecognized tax benefits in its income tax provision. As of January 31, 2009, the

Company accrued no penalties and an insignificant amount of interest was recorded in income tax expense.

Tax positions for the Company and its subsidiaries are subject to income tax audits by many tax jurisdictions throughout the world. The Company's

U.S. federal and state tax returns for all tax years since February 1999, which was the inception of the Company, remain open to examination. Outside the

U.S., tax returns filed in major jurisdictions where the Company operates, including Canada, United Kingdom, and Australia generally remain open to

examination for all tax years, while for Japan, the statute of limitations currently remains open for tax years after fiscal year 2003. During fiscal year 2009, the

Internal Revenue Service completed its examination of the Company's federal income tax return for fiscal year ended January 31, 2006. No adjustment was

made as a result of the audit.

86