Salesforce.com 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

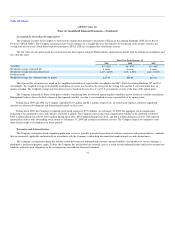

certificates of deposit and commercial paper issued by highly-rated institutions. Management also evaluated the fair value of its ownership in The Reserve

Fund, considering risk of extended timing and other factors. The assumption of timing for the actual repayment of the Company's ownership from The

Reserve Fund is inherently subjective and involves significant management judgment. For the Company's investments in privately-held companies

management evaluated financial results, earnings trends, and subsequent financing of these companies, as well as general market conditions to determine fair

value. As a result, the Company classified its ownership in The Reserve Fund and investments in privately-held companies within Level 3 of the fair value

hierarchy.

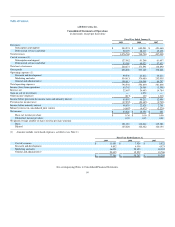

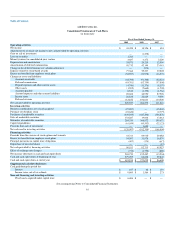

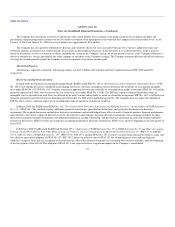

The following table presents information about the Company's assets that are measured at fair value on a recurring basis as of January 31, 2009 and

indicates the fair value hierarchy of the valuation (in thousands):

Description

Quoted Prices in

Active Markets

for Identical Assets

(Level 1)

Significant Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Balances as of

January 31, 2009

Cash equivalents (1):

Time deposits $ 402 $ — $ — $ 402

Money market mutual funds 279,246 — — 279,246

Corporate notes and obligations — 7,990 — 7,990

U.S. agency obligations — 87,852 — 87,852

Marketable securities:

Corporate notes and obligations — 215,140 — 215,140

U.S. agency obligations — 165,297 — 165,297

Money market mutual fund — — 18,294 18,294

Foreign currency derivative contracts (2) — 1,054 — 1,054

Investments in privately-held

companies (3) — — 2,400 2,400

Total Assets $ 279,648 $ 477,333 $ 20,694 $ 777,675

Liabilities

Foreign currency derivative contracts (4) $ — $ 2,058 $ — $ 2,058

Total Liabilities $ — $ 2,058 $ — $ 2,058

(1) Included in "cash and cash equivalents" in the accompanying Consolidated Balance Sheet as of January 31, 2009, in addition to $108,344 of cash.

(2) Included in "prepaid expenses and other current assets" in the accompanying Consolidated Balance Sheet as of January 31, 2009.

(3) Included in "other assets, net" in the accompanying Consolidated Balance Sheet as of January 31, 2009.

(4) Included in "accrued expenses and other current liabilities" in the accompanying Consolidated Balance Sheet as of January 31, 2009.

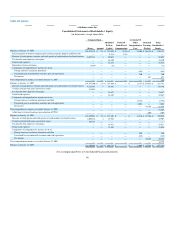

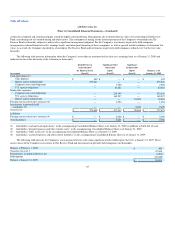

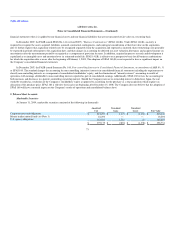

The following table presents the Company's assets measured at fair value using significant unobservable inputs (Level 3) at January 31, 2009. These

assets consist of the Company's investment in The Reserve Fund and Investments in privately-held companies (in thousands):

Balance at February 1, 2008 $ 500

Transfers to Level 3 47,026

Realized loss included in Interest, net (1,204)

Redemptions (25,628)

Balance at January 31, 2009 $ 20,694

65