Salesforce.com 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

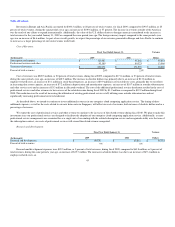

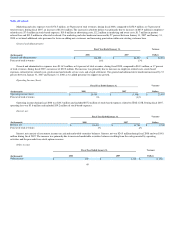

Interest, net consists of investment income on cash and marketable securities balances. Interest, net was $22.7 million during fiscal 2009 and was $24.5

million during the same period a year ago. The decrease was primarily due to a $1.8 million loss for our investment in marketable securities as discussed

under "Liquidity and Capital Resources." Due to the current decline in market interest rates since last year and our focus on capital preservation, investment

income declined when compared to the same periods in the previous year.

Gain on Sale of Investment.

Gain on sale of investment of $1.3 million for fiscal 2008 consists of the gain we recorded when we sold our shares in a privately held professional

service corporation.

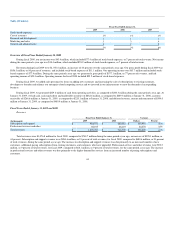

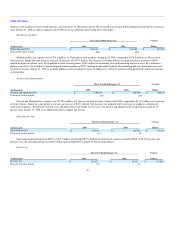

Other income (expense).

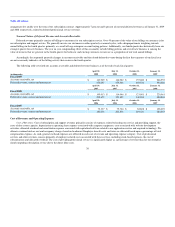

(In thousands) Fiscal Year Ended January 31, Variance

Dollars 2009 2008

Other income (expense) $ (817) $ 139 $ (956)

Other income (expense) primarily consists of foreign currency translation adjustments. Other income (expense) decreased due to realized and

unrealized gains on foreign currency translations for the year ended January 31, 2009 when compared to the same period a year ago.

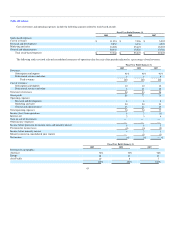

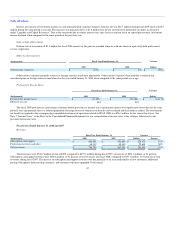

Provision for Income Taxes.

Fiscal Year Ended January 31, Variance

Dollars

(In thousands) 2009 2008

Provision for income taxes $ (37,557) $ (23,385) $ (14,172)

Effective tax rate 44% 51%

The fiscal 2009 provision as a percentage of income before provision for income taxes and minority interest was significantly lower than for the same

period a year ago primarily due to a reduced proportion of foreign losses for which no tax benefit can be realized and increased tax credits. The total income

tax benefit recognized in the accompanying consolidated statement of operations related to SFAS 123R was $26.3 million for the current fiscal year. See

Note 7 "Income Taxes" to the Notes to the Consolidated Financial Statements for our reconciliation of income taxes at the statutory federal rate to the

provision for income taxes.

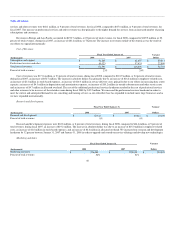

Fiscal Years Ended January 31, 2008 and 2007

Revenues.

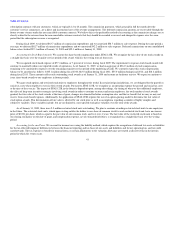

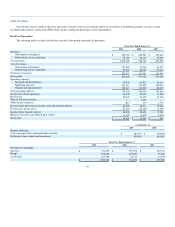

Fiscal Year Ended January 31, Variance

(In thousands) 2008 2007 Dollars Percent

Subscription and support $ 680,581 $ 451,660 $ 228,921 51%

Professional services and other 68,119 45,438 22,681 50%

Total revenues $ 748,700 $ 497,098 $ 251,602 51%

Total revenues were $748.7 million for fiscal 2008, compared to $497.1 million during fiscal 2007, an increase of $251.6 million, or 51 percent.

Subscription and support revenues were $680.6 million, or 91 percent of total revenues, for fiscal 2008, compared to $451.7 million, or 91 percent of total

revenues, during fiscal 2007. The increase in subscription and support revenues was due primarily to an increased number of new customers, additional

paying subscriptions from existing customers, and customers who have upgraded. Professional

47