Salesforce.com 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

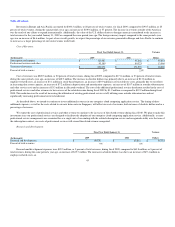

We believe our existing cash, cash equivalents and short-term marketable securities and cash provided by operating activities will be sufficient to meet

our working capital and capital expenditure needs over the next 12 months.

During fiscal 2010, we may enter into arrangements to acquire or invest in other businesses, services or technologies. While we believe we have

sufficient financial resources, we may be required to seek additional equity or debt financing. Additional funds may not be available on terms favorable to us

or at all.

Recent Accounting Pronouncements

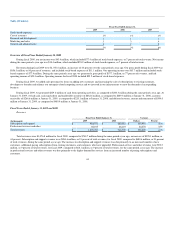

In April 2008, the Financial Accounting Standards Board (FASB) issued FSP No. 142-3, "Determination of the Useful Life of Intangible Assets" (FSP

No. 142-3) that amends the factors considered in developing renewal or extension assumptions used to determine the useful life of a recognized intangible

asset under SFAS No. 142. FSP No. 142-3 requires a consistent approach between the useful life of a recognized intangible asset under SFAS No. 142 and the

period of expected cash flows used to measure the fair value of an asset under SFAS No. 141(R). The FSP also requires enhanced disclosures when an

intangible asset's expected future cash flows are affected by an entity's intent and/or ability to renew or extend the arrangement. FSP No. 142-3 is effective for

financial statements issued for fiscal years beginning after December 15, 2008 and is applied prospectively. We do not expect the adoption of FSP No. 142-3

to have a material impact on our consolidated results of operations or financial condition.

In March 2008, the FASB issued SFAS No. 161, "Disclosures about Derivative Instruments and Hedging Activities—an amendment of FASB Statement

No. 133" (SFAS 161). The standard requires additional quantitative disclosures (provided in tabular form) and qualitative disclosures for derivative

instruments. The required disclosures include how derivative instruments and related hedged items affect an entity's financial position, financial performance,

and cash flows; the relative volume of derivative activity; the objectives and strategies for using derivative instruments; the accounting treatment for those

derivative instruments formally designated as the hedging instrument in a hedge relationship; and the existence and nature of credit-risk-related contingent

features for derivatives. SFAS 161 does not change the accounting treatment for derivative instruments. SFAS 161 is effective beginning in the first quarter of

fiscal 2010.

In February 2008, the FASB issued FASB Staff Position 157-1, "Application of FASB Statement No. 157 to FASB Statement No. 13 and Other

Accounting Pronouncements That Address Fair Value Measurements for Purposes of Lease Classification or Measurement under Statement 13" (FSP 157-1)

and FSP 157-2, "Effective Date of FASB Statement No. 157" (FSP 157-2). FSP 157-1 amends SFAS No. 157 to remove certain leasing transactions from its

scope, and was effective upon initial adoption of SFAS No. 157. FSP 157-2 delays the effective date of SFAS 157 for all non-financial assets and non-

financial liabilities, except for items that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually), until the

beginning of the first quarter of fiscal 2010. The adoption of SFAS 157 is not expected to have a significant impact on our consolidated financial statements

when it is applied to non-financial assets and non-financial liabilities that are not measured at fair value on a recurring basis.

In December 2007, the FASB issued SFAS No. 141 (revised 2007), "Business Combinations" (SFAS 141(R)). Under SFAS 141(R), an entity is

required to recognize the assets acquired, liabilities assumed, contractual contingencies, and contingent consideration at their fair value on the acquisition

date. It further requires that acquisition-related costs be recognized separately from the acquisition and expensed as incurred; that restructuring costs generally

be expensed in periods subsequent to the acquisition date; and that changes in accounting for deferred tax asset valuation allowances and acquired income tax

uncertainties after the measurement period be recognized as a component of provision for taxes. In addition, acquired in-process research and development is

capitalized as an intangible asset and amortized over its estimated useful life. SFAS 141(R) is effective on a prospective basis for all business combinations

for which the acquisition date is on or after the beginning of February 1, 2009, The adoption of SFAS 141(R) is not expected to have a significant impact on

our consolidated financial statements.

52