Salesforce.com 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

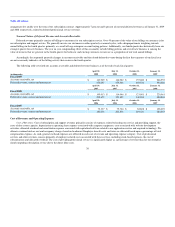

arrangement fee ratably over the term of the subscription contract. Approximately 7 percent and 8 percent of our total deferred revenue as of January 31, 2009

and 2008 respectively, related to deferred professional services revenue.

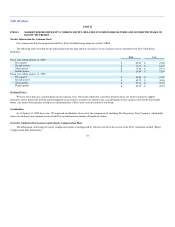

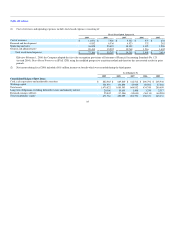

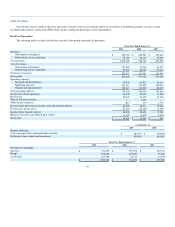

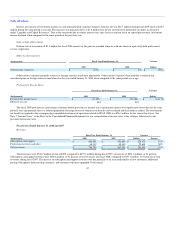

Seasonal Nature of Deferred Revenue and Accounts Receivable

Deferred revenue primarily consists of billings to customers for our subscription service. Over 90 percent of the value of our billings to customers is for

our subscription and support service. We generally invoice our customers in either quarterly or annual cycles, with a disproportionate weighting towards

annual billings in the fourth quarter, primarily as a result of large enterprise account buying patterns. Additionally, our fourth quarter has historically been our

strongest quarter for new business. The year on year compounding effect of this seasonality in both billing patterns and overall new business is causing the

value of invoices that we generate in the fourth quarter for both new and existing customers to increase as a proportion of our total annual billings.

Accordingly, the sequential quarterly changes in accounts receivable and the related deferred revenue during the first three quarters of our fiscal year

are not necessarily indicative of the billing activity that occurs in the fourth quarter.

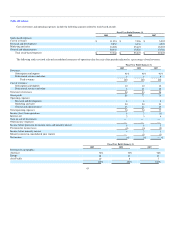

The following table sets forth our accounts receivable and deferred revenue balances as of the end of each fiscal quarter:

(in thousands)

April 30,

2008

July 31,

2008

October 31,

2008

January 31,

2009

Fiscal 2009

Accounts receivable, net $ 143,909 $ 146,982 $ 157,680 $ 266,555

Deferred revenue, current and noncurrent 470,297 479,546 469,534 594,026

April 30,

2007

July 31,

2007

October 31,

2007

January 31,

2008

Fiscal 2008

Accounts receivable, net $ 105,013 $ 114,046 $ 121,961 $ 220,061

Deferred revenue, current and noncurrent 295,672 321,852 340,808 480,894

April 30,

2006

July 31,

2006

October 31,

2006

January 31,

2007

Fiscal 2007

Accounts receivable, net $ 72,337 $ 75,704 $ 82,808 $ 128,693

Deferred revenue, current and noncurrent 182,036 202,836 219,431 284,063

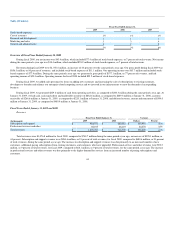

Cost of Revenues and Operating Expenses

Cost of Revenues. Cost of subscription and support revenues primarily consists of expenses related to hosting our service and providing support, the

costs of data center capacity, depreciation or operating lease expense associated with computer equipment, costs associated with website development

activities, allocated overhead and amortization expense associated with capitalized software related to our application service and acquired technology. We

allocate overhead such as rent and occupancy charges based on headcount. Employee benefit costs and taxes are allocated based upon a percentage of total

compensation expense. As such, general overhead expenses are reflected in each cost of revenue and operating expense category. Cost of professional

services and other revenues consists primarily of employee-related costs associated with these services, including stock-based expenses, the cost of

subcontractors and allocated overhead. The cost of providing professional services is significantly higher as a percentage of revenue than for our enterprise

cloud computing subscription service due to the direct labor costs.

38