Salesforce.com 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

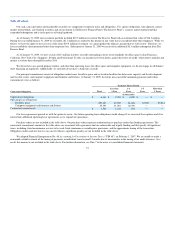

Table of Contents

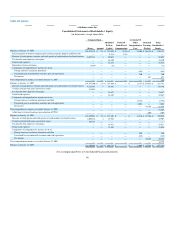

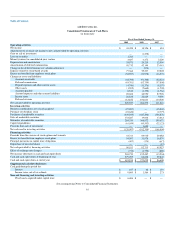

salesforce.com, inc.

Consolidated Statements of Stockholders' Equity

(in thousands, except share data)

Common Stock Additional

Paid-in

Capital

Deferred

Stock-Based

Compensation

Accumulated

Other

Comprehensive

Loss

Retained

Earnings

(Deficit)

Total

Stockholders'

Equity Shares Amount

Balances at January 31, 2006 110,513,576 $ 111 $ 237,010 $ (2,531) $ (2,105) $ (36,114) $ 196,371

Reclassification of deferred compensation resulting from the adoption of SFAS 123R — — (2,531) 2,531 — — —

Exercise of stock options, warrants and stock grants to board members for board services 4,032,132 4 29,691 — — — 29,695

Tax benefits from employee stock plans — — 16,480 — — — 16,480

Stock-based expenses — — 38,858 — — — 38,858

Repurchase of unvested shares (8,148) — (12) — — — (12)

Components of comprehensive income, net of tax:

Foreign currency translation adjustment — — — — (842) — (842)

Unrealized gain on marketable securities and cash equivalents — — — — 760 — 760

Net income — — — — — 481 481

Total comprehensive income, year ended January 31, 2007 — — — — — — 399

Balances at January 31, 2007 114,537,560 $ 115 $ 319,496 $ — $ (2,187) $ (35,633) $ 281,791

Exercise of stock options, warrants and stock grants to board members for board services 4,533,418 4 63,192 — — — 63,196

Vested restricted stock units converted to shares 234,035 — — — — — —

Tax benefits from employee stock plans — — 34,847 — — — 34,847

Stock-based expenses — — 54,267 — — — 54,267

Components of comprehensive income, net of tax:

Foreign currency translation adjustment and other — — — — (2,753) — (2,753)

Unrealized gain on marketable securities and cash equivalents — — — — 2,664 — 2,664

Net income — — — — — 18,356 18,356

Total comprehensive income, year ended January 31, 2008 — — — — — — 18,267

Adjustment to retained earnings upon adoption of FIN 48 (309) (309)

Balances at January 31, 2008 119,305,013 $ 119 $ 471,802 $ — $ (2,276) $ (17,586) $ 452,059

Exercise of stock options and stock grants to board members for board services 3,009,276 4 45,903 — — — 45,907

Vested restricted stock units converted to shares 535,773 — — — — — —

Tax benefits from employee stock plans — — 55,421 — — — 55,421

Stock-based expenses — — 75,598 — — — 75,598

Components of comprehensive income, net of tax:

Foreign currency translation adjustment and other — — — — 260 — 260

Unrealized loss on marketable securities and cash equivalents — — — — (889) — (889)

Net income — — — — — 43,428 43,428

Total comprehensive income, year ended January 31, 2009 — — — — — — 42,799

Balances at January 31, 2009 122,850,062 $ 123 $ 648,724 $ — $ (2,905) $ 25,842 $ 671,784

See accompanying Notes to Consolidated Financial Statements.

60