Salesforce.com 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

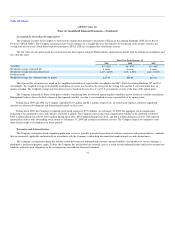

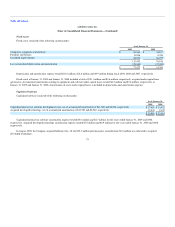

In fiscal 2009, 2008 and 2007, the joint venture granted options to purchase 16,500, 11,600 and 8,400 shares, respectively, to its employees to purchase

shares of common stock in the joint venture. The stock options were issued with an exercise price ranging from ¥20,000 to ¥60,000 per share (approximately

$223 to $669 per share), ¥20,000 (approximately $171 per share), and ¥4,000 to ¥15,000 a per share (approximately $34 to $129 per share), respectively.

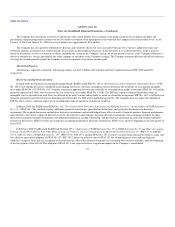

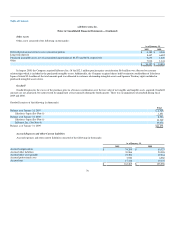

Given the Company's majority ownership interest in the joint venture, the accounts of the joint venture have been consolidated with the accounts of the

Company, and a minority interest has been recorded for the third party's interest in the net assets and operations of the joint venture to the extent of the

minority partners' individual investments. All intercompany transactions have been eliminated, with the exception of minority interest.

Under the terms of the joint venture agreement, the joint venture will terminate if the joint venture becomes a public company or is sold to a third party,

or upon the mutual agreement of the parties. In addition, if the Company commits a breach of, or if the Company fails to perform, its material obligations

under the joint venture agreement, which are not cured in a timely manner, SunBridge can require the Company to purchase all of its shares in the joint

venture. The purchase price for SunBridge's shares would be the then fair market value plus a specified premium. In the event that SunBridge commits a

breach of, or if it fails to perform, its material obligations under the joint venture agreement, which it does not cure in a timely manner, or if SunBridge enters

into bankruptcy proceedings, the Company can require SunBridge to sell to it all of their shares in the joint venture. The purchase price for SunBridge's shares

would be the then fair market value less a specified discount. Additionally, if the Company and SunBridge are unable to agree on certain operational matters,

either party can require the other to purchase all of its shares of the joint venture at a price equal to the then fair value market value. Fair market value is to be

determined by mutual agreement of the parties, or if the parties are unable to agree, by an independent appraiser.

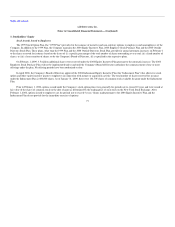

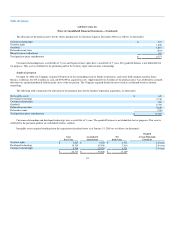

6. Acquisitions

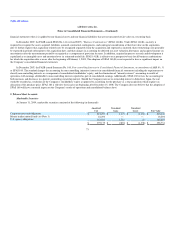

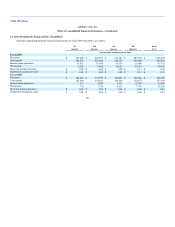

InStranet, Inc.

In August 2008, the Company acquired 100 percent of the outstanding stock of InStranet, Inc. ("InStranet"), a privately-held company with operations

in Paris, France, and Chicago, Illinois for $32.3 million in cash, including $0.7 million in transaction costs. InStranet offers a knowledge management

application for business to consumer call centers. The Company acquired InStranet for its developed technology in order to expand its CRM customer service

and support offerings in the customer service and support market. The Company accounted for this acquisition using Statement of Financial Accounting

Standards No. 141, Business Combinations. Accordingly, the results of operations for the acquired business are included in the accompanying consolidated

statements of operations since the acquisition date, and the related assets and liabilities were recorded based upon their fair values as of the acquisition date.

Proforma results of operations have not been presented because the effects of the acquisition was not significant.

81