Salesforce.com 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

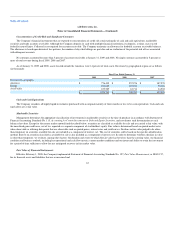

Accounting for Stock-Based Compensation

The Company accounts for its employee stock-based compensation pursuant to Statement of Financial Accounting Standards 123R, Share-Based

Payment ("SFAS 123R"). The Company recognizes share-based expenses on a straight-line over the requisite service period of the awards, which is the

vesting term of four years. Stock-based expenses pursuant to SFAS 123R are recognized net of forfeiture activity.

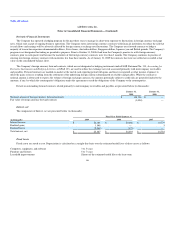

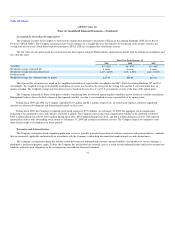

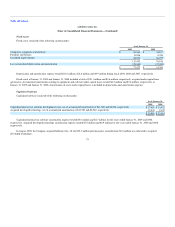

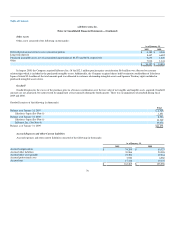

The fair value of each option grant was estimated on the date of grant using the Black-Scholes option pricing model with the following assumptions and

fair value per share:

Fiscal Year Ended January 31,

2009 2008 2007

Volatility 47 - 60% 46 - 47% 46 - 50%

Weighted-average estimated life 4 years 4 years 4 years

Weighted-average risk-free interest rate 1.47 - 3.08% 3.32 - 4.55% 4.42 - 5.03%

Dividend yield — — —

Weighted-average fair value per share of grants $15.39 $20.49 $14.92

The expected life of options was based on the simplified calculation of expected life, described in the SEC's Staff Accounting Bulletins 107 and 110.

Accordingly, the weighted-average estimated life assumption of 4 years was based on the average of the vesting term and the 5 year contractual lives of

options awarded. The weighted-average risk free interest rate is based on the rate for a 4 year U.S. government security at the time of the option grant.

The Company estimated its future stock price volatility considering both its observed option-implied volatilities and its historical volatility calculations.

Management believes this is the best estimate of the expected volatility over the 4 year weighted-average expected life of its option grants.

During fiscal 2009 and 2008, the Company capitalized $1.9 million and $2.1 million, respectively, of stock-based expenses related to capitalized

internal-use software development and deferred professional services costs.

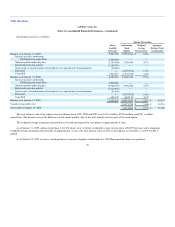

During fiscal 2009, the Company recognized stock-based expense of $77.4 million. As of January 31, 2009, the aggregate stock compensation

remaining to be amortized to costs and expenses was $261.3 million. The Company expects this stock compensation balance to be amortized as follows:

$105.1 million during fiscal 2010; $83.0 million during fiscal 2011; $55.0 million during fiscal 2012; and $18.2 million during fiscal 2013. The expected

amortization reflects only outstanding stock awards as of January 31, 2009 and assumes no forfeiture activity. The Company expects to continue to issue

share-based awards to its employees in future periods.

Warranties and Indemnification

The Company's enterprise cloud computing application service is typically warranted to perform in a manner consistent with general industry standards

that are reasonably applicable and materially in accordance with the Company's online help documentation under normal use and circumstances.

The Company's arrangements generally include certain provisions for indemnifying customers against liabilities if its products or services infringe a

third-party's intellectual property rights. To date, the Company has not incurred any material costs as a result of such indemnifications and has not accrued any

liabilities related to such obligations in the accompanying consolidated financial statements.

71