Salesforce.com 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

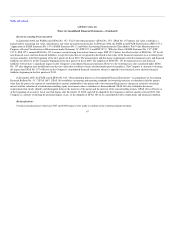

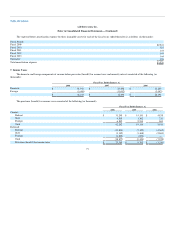

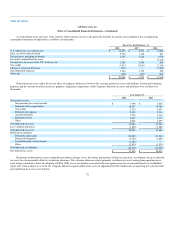

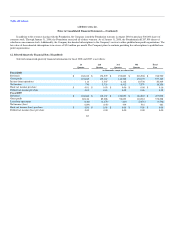

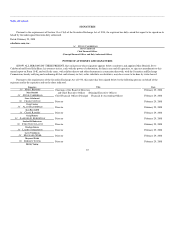

The expected future amortization expense for these intangible assets for each of the fiscal years ended thereafter is as follows (in thousands):

Fiscal Period:

Fiscal 2009 $2,241

Fiscal 2010 727

Fiscal 2011 144

Fiscal 2012 144

Fiscal 2013 144

Thereafter 126

Total amortization expense $3,526

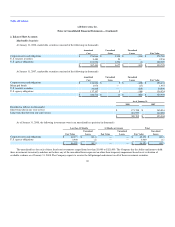

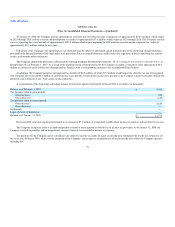

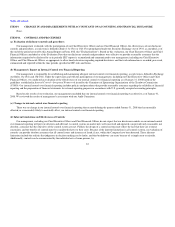

7. Income Taxes

The domestic and foreign components of income before provision (benefit) for income taxes and minority interest consisted of the following (in

thousands):

Fiscal Year Ended January 31,

2008 2007 2006

Domestic $ 51,911 $ 23,498 $ 31,240

Foreign (5,698) (11,002) (3,042)

$ 46,213 $ 12,496 $ 28,198

The provision (benefit) for income taxes consisted of the following (in thousands):

Fiscal Year Ended January 31,

2008 2007 2006

Current:

Federal $ 31,245 $ 15,243 $ 4,835

State 4,515 1,362 211

Foreign 6,502 2,514 869

Total 42,262 19,119 5,915

Deferred:

Federal (13,800) (7,122) (4,362)

State (3,192) (1,368) (2,863)

Foreign (1,885) (834) —

Total (18,877) (9,324) (7,225)

Provision (benefit) for income taxes $ 23,385 $ 9,795 $ (1,310)

77