Salesforce.com 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

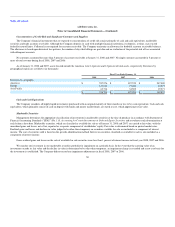

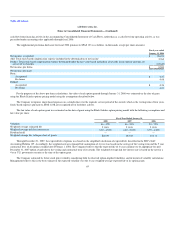

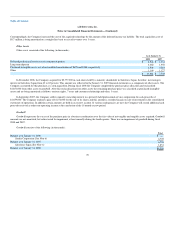

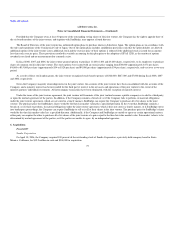

Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets consisted of the following (in thousands):

As of January 31,

2008 2007

Deferred professional services costs $ 9,376 $ 3,898

Prepaid expenses and other current assets 17,679 11,781

$ 27,055 $ 15,679

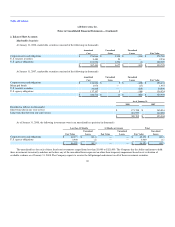

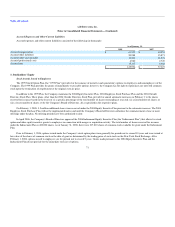

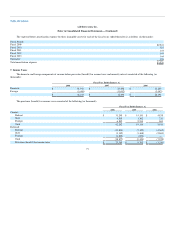

Fixed Assets

Fixed assets consisted of the following (in thousands):

As of January 31,

2008 2007

Computers, equipment and software $ 34,197 $ 29,440

Furniture and fixtures 8,354 3,866

Leasehold improvements 36,279 20,757

78,830 54,063

Less accumulated depreciation and amortization (37,450) (23,908)

$ 41,380 $ 30,155

Depreciation and amortization expense totaled $16,835,000, $9,928,000 and $5,584,000 during fiscal 2008, 2007 and 2006, respectively.

Fixed assets at January 31, 2008 and January 31, 2007 included a total of $3,627,000 acquired under capital lease agreements. Accumulated

amortization relating to equipment and software under capital leases totaled $3,619,000 and $3,364,000, respectively, at January 31, 2008 and January 31,

2007. Amortization of assets under capital leases is included in depreciation and amortization expense.

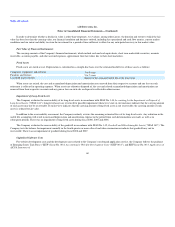

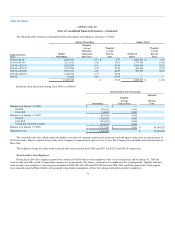

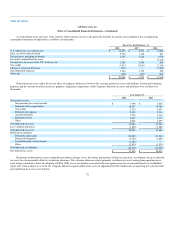

Capitalized Software

Capitalized software consisted of the following (in thousands):

As of January 31,

2008 2007

Capitalized internal-use software development costs, net of accumulated amortization of $4,898 and $2,150, respectively $ 13,932 $ 5,626

Acquired developed technology, net of accumulated amortization of $6,542 and $1,653, respectively 9,129 5,357

$ 23,061 $ 10,983

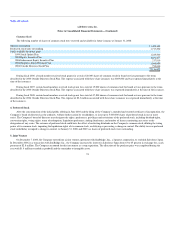

In March 2007, the Company acquired 100 percent of the outstanding stock of a corporation, whose principal asset was developed technology, for $5.3

million in cash. The Company accounted for this acquisition as a capital expenditure as the acquired entity did not meet the accounting definition of a

business. As part of the acquisition accounting, the Company recorded a $3.4 million deferred income tax liability to reflect the tax effect of the difference

between the $5.3 million in cash paid and the tax basis of the technology acquired.

69