Salesforce.com 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

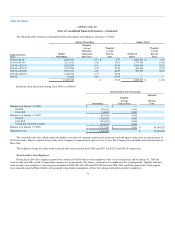

In determining whether the consulting services can be accounted for separately from subscription and support revenues, the Company considers the

following factors for each consulting agreement: availability of the consulting services from other vendors, whether objective and reliable evidence for fair

value exists for the undelivered elements, the nature of the consulting services, the timing of when the consulting contract was signed in comparison to the

subscription service start date, and the contractual dependence of the subscription service on the customer's satisfaction with the consulting work. If a

consulting arrangement does not qualify for separate accounting, the Company recognizes the consulting revenue ratably over the remaining term of the

subscription contract. Additionally, in these situations, the Company defers only the direct costs of the consulting arrangement and amortizes those costs over

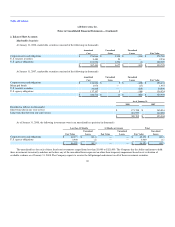

the same time period as the consulting revenue is recognized. As of January 31, 2008 and 2007, the deferred cost on the accompanying consolidated balance

sheet totaled $13,922,000 and $5,232,000, respectively. These deferred costs are included in prepaid expenses and other current assets and other assets.

Deferred Revenue

Deferred revenue primarily consists of billings or payments received in advance of revenue recognition from the Company's subscription service

described above and is recognized as the revenue recognition criteria are met. The Company generally invoices its customers in annual or quarterly

installments. Accordingly, the deferred revenue balance does not represent the total contract value of annual or multi-year, noncancelable subscription

agreements. Deferred revenue also includes certain deferred professional services fees which are recognized as revenue ratably over the subscription contract

term. The Company defers the professional service fees in situations where the professional services and subscription contracts are accounted for as a single

unit of accounting. Deferred revenue that will be recognized during the succeeding 12-month period is recorded as current deferred revenue and the remaining

portion is recorded as noncurrent.

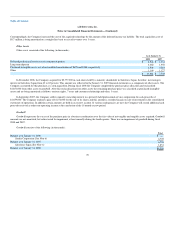

Deferred Commissions

Deferred commissions are the incremental costs that are directly associated with noncancelable subscription contracts with customers and consist of

sales commissions paid to the Company's direct sales force. The commissions are deferred and amortized over the noncancelable terms of the related customer

contracts, which are typically 12 to 24 months. The commission payments are paid in full the month after the customer's service commences. The deferred

commission amounts are recoverable through the future revenue streams under the noncancelable customer contracts. The Company believes this is the

preferable method of accounting as the commission charges are so closely related to the revenue from the noncancelable customer contracts that they should

be recorded as an asset and charged to expense over the same period that the subscription revenue is recognized. Amortization of deferred commissions is

included in marketing and sales expense in the accompanying consolidated statements of operations.

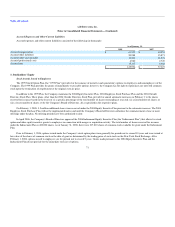

Accounting for Stock-Based Compensation

Prior to February 1, 2006, the Company accounted for employee stock-based compensation using the intrinsic value method supplemented by pro

forma disclosures in accordance with Accounting Principles Board ("APB") Opinion No. 25, Accounting for Stock Issued to Employees ("APB 25") and

Statement of Financial Accounting Standards ("SFAS") No. 123, Accounting for Stock-Based Compensation ("SFAS 123"), as amended by SFAS 148,

Accounting for Stock-Based Compensation—Transition and Disclosure ("SFAS 148"). Effective February 1, 2006, the Company adopted Statement of

Financial Accounting Standards 123R, Share-Based Payment ("SFAS 123R") using the modified prospective approach and accordingly fiscal 2006 was not

restated to reflect the impact of SFAS 123R.

Upon adoption of SFAS 123R, beginning in fiscal 2007, the Company presented the benefits of tax deductions in excess of recognized compensation

expense ("excess tax benefits from employee stock plans") as a

64