Salesforce.com 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

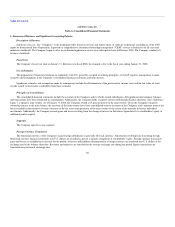

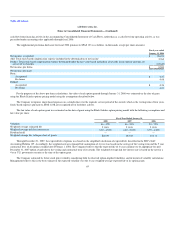

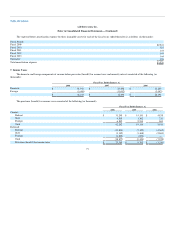

2. Balance Sheet Accounts

Marketable Securities

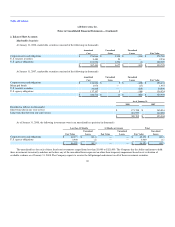

At January 31, 2008, marketable securities consisted of the following (in thousands):

Amortized

Cost

Unrealized

Gains

Unrealized

Losses Fair Value

Corporate notes and obligations $ 276,866 $ 2,328 $ (414) $ 278,780

U.S. treasury securities 9,483 53 — 9,536

U.S. agency obligations 101,094 1,296 (1) 102,389

$ 387,443 $ 3,677 $ (415) $ 390,705

At January 31, 2007, marketable securities consisted of the following (in thousands):

Amortized

Cost

Unrealized

Gains

Unrealized

Losses Fair Value

Corporate notes and obligations $ 156,826 $ 9 $ (402) $ 156,433

Municipal bonds 1,974 — (17) 1,957

U.S. treasury securities 30,805 — (215) 30,590

U.S. agency obligations 137,107 5 (188) 136,924

$ 326,712 $ 14 $ (822) $ 325,904

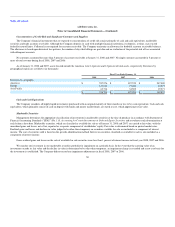

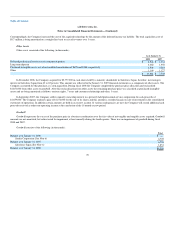

As of January 31,

2008 2007

Recorded as follows (in thousands):

Short-term (due in one year or less) $ 171,748 $ 165,816

Long-term (due between one and 3 years) 218,957 160,088

$ 390,705 $ 325,904

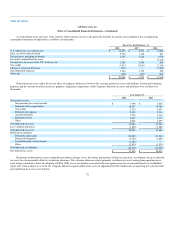

As of January 31, 2008, the following investments were in an unrealized loss position (in thousands):

Less than 12 Months 12 Months or Greater Total

Fair Value

Unrealized

Losses Fair Value

Unrealized

Losses Fair Value

Unrealized

Losses

Corporate notes and obligations $ 42,171 $ (414) — — $ 42,171 $ (414)

U.S. agency obligations 3,949 (1) — — 3,949 (1)

$ 46,120 $ (415) — — $ 46,120 $ (415)

The unrealized loss for each of these fixed rate investments ranged from less than $1,000 to $121,000. The Company has the ability and intent to hold

these investments to maturity and does not believe any of the unrealized losses represent an other-than-temporary impairment based on its evaluation of

available evidence as of January 31, 2008. The Company expects to receive the full principal and interest on all of these investment securities.

68