Salesforce.com 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The (provision) benefit amounts equated to an effective tax rate of 78 percent for fiscal 2007 and a negative 5 percent for the same period a year ago.

The fiscal 2007 provision as a percentage of income before provision for income taxes and minority interest was significantly higher than for the same

period a year ago primarily due to foreign losses for which no tax benefit can be realized, certain nondeductible stock-based expenses resulting from the

adoption of SFAS 123R and the $7.2 million reversal of the valuation allowance a year ago.

Additionally, the impact of adopting SFAS 123R and the business combination accounting adjustments from the acquisition of Sendia Corporation had

a significant impact on the calculation of our effective tax rate because these charges significantly lowered our income before provision for income taxes and

minority interest and we were not able to recognize a full income tax benefit for the stock-based expenses and foreign losses.

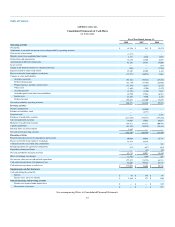

Liquidity and Capital Resources

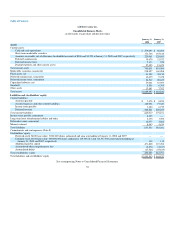

At January 31, 2008, our principal sources of liquidity were cash, cash equivalents and marketable securities totaling $669.8 million and accounts

receivable of $220.1 million.

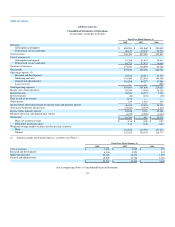

Net cash provided by operating activities was $204.3 million during fiscal 2008 and $111.2 million during the same period a year ago. The

improvement in cash flow was due primarily to the increased number of paying subscribers to our service. Cash provided by operating activities has

historically been affected by sales of subscriptions and support and professional services, changes in working capital accounts, particularly increases in

accounts receivable and deferred revenue and the timing of commission and bonus payments, and add-backs of non-cash expense items such as depreciation

and amortization and the expense associated with stock-based awards.

Net cash used in investing activities was $102.7 million during fiscal 2008 and $168.6 million during the same period a year ago. The net cash used in

investing activities during fiscal 2008 primarily related to the investment of operating cash balances and capital expenditures associated with leasehold

improvements, development of internal use software and the purchase of software licenses, computer equipment and furniture and fixtures as we have

expanded our infrastructure, number of offices around the world and work force. Additionally, in March 2007, we acquired additional developed technology

for $5.3 million in cash.

Net cash provided by financing activities was $92.7 million during fiscal 2008 and $45.0 million during the same period a year ago. Net cash provided

by financing activities during fiscal 2008 substantially consisted of $60.9 million of proceeds from the exercise of employee stock options and $32.0 million

of excess tax benefits from employee stock plans.

As of January 31, 2008, we have a total of $5.9 million in letters of credit outstanding in favor of our landlords for office space in San Francisco,

California, New York City, Singapore, Sweden and Switzerland. To date, no amounts have been drawn against the letters of credit, which renew annually and

mature at various dates through December 2015.

We do not have any special purpose entities, and other than operating leases for office space and computer equipment, we do not engage in off-balance

sheet financing arrangements. Additionally, we currently do not have a bank line of credit.

47