Salesforce.com 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

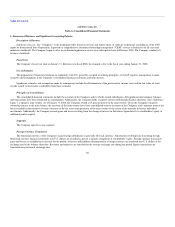

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

In order to determine whether a decline in value is other-than-temporary, we evaluate, among other factors: the duration and extent to which the fair

value has been less than the carrying value, our financial condition and business outlook, including key operational and cash flow metrics, current market

conditions and our intent and ability to retain the investment for a period of time sufficient to allow for any anticipated recovery in fair market value.

Fair Value of Financial Instruments

The carrying amounts of the Company's financial instruments, which include cash and cash equivalents, short term marketable securities, accounts

receivable, accounts payable, and other accrued expenses, approximate their fair values due to their short maturities.

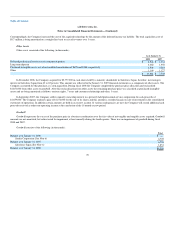

Fixed Assets

Fixed assets are stated at cost. Depreciation is calculated on a straight-line basis over the estimated useful lives of those assets as follows:

Computers, equipment, and software 3 to 5 years

Furniture and fixtures 5 to 7 years

Leasehold improvements Shorter of the estimated useful life or the lease term

When assets are retired, the cost and accumulated depreciation and amortization are removed from their respective accounts and any loss on such

retirement is reflected in operating expenses. When assets are otherwise disposed of, the cost and related accumulated depreciation and amortization are

removed from their respective accounts and any gain or loss on such sale or disposal is reflected in other income.

Impairment of Long-Lived Assets

The Company evaluates the recoverability of its long-lived assets in accordance with SFAS No. 144, Accounting for the Impairment or Disposal of

Long-Lived Assets ("SFAS 144"). Long-lived assets are reviewed for possible impairment whenever events or circumstances indicate that the carrying amount

of such assets may not be recoverable. If such review indicates that the carrying amount of long-lived assets is not recoverable, the carrying amount of such

assets is reduced to fair value.

In addition to the recoverability assessment, the Company routinely reviews the remaining estimated lives of its long-lived assets. Any reduction in the

useful life assumption will result in increased depreciation and amortization expense in the period when such determinations are made, as well as in

subsequent periods. There was no impairment of long-lived assets during fiscal 2008, 2007 and 2006.

The Company evaluates the recoverability of the goodwill in accordance with SFAS No. 142, Goodwill and Other Intangible Assets ("SFAS 142"). The

Company tests the balance for impairment annually in the fourth quarter or more often if and when circumstances indicate that goodwill may not be

recoverable. There was no impairment of goodwill during fiscal 2008 and 2007.

Capitalized Software Costs

For website development costs and the development costs related to the Company's on-demand application service, the Company follows the guidance

of Emerging Issues Task Force ("EITF") Issue No. 00-2, Accounting for Web Site Development Costs ("EITF 00-2"), and EITF Issue No. 00-3, Application of

AICPA Statement of

60