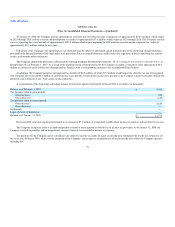

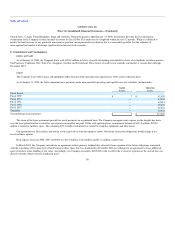

Salesforce.com 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

Correspondingly, the Company increased the cost of the acquired technology by the amount of the deferred income tax liability. The total acquisition cost of

$8.7 million is being amortized on a straight-line basis to cost of revenues over 3 years.

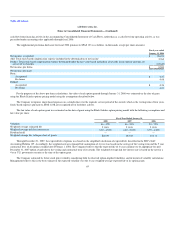

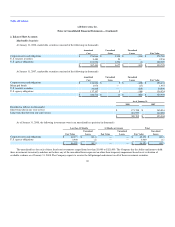

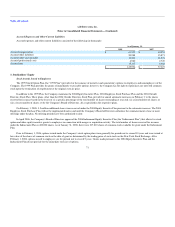

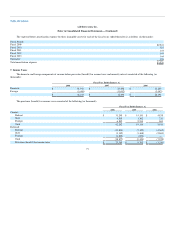

Other Assets

Other assets consisted of the following (in thousands):

As of January 31,

2008 2007

Deferred professional services costs, noncurrent portion $ 4,546 $ 1,334

Long-term deposits 6,682 1,958

Purchased intangible assets, net of accumulated amortization of $678 and $184, respectively 1,509 3,283

Other 1,144 1,127

$ 13,881 $ 7,702

In December 2006, the Company acquired for $2,777,000 in cash shares held by a minority shareholder in Salesforce Japan, therefore, increasing its

interest in Salesforce Japan from 63 to 65 percent. This amount was reflected in the January 31, 2007 financial statements as a component of other assets. The

Company accounted for this purchase as a step acquisition. During fiscal 2008 the Company completed the purchase price allocation and reclassified

$1,851,000 from other assets to goodwill. After this reclassification from other assets the remaining purchase price was classified as purchased intangible

assets and are being amortized as follows: territory rights, 7 years and customer relationship and other, 3 years.

In September 2007, the Company sold its minority ownership interest in a privately held professional services corporation for cash proceeds of

$1,659,000. The Company realized a gain of $1,272,000 for the sale of its shares and this amount is recorded in gain on sale of investment in the consolidated

statements of operations. In addition certain amounts are held in an escrow account. If various contingencies are met, the Company will record additional cash

proceeds received as other non-operating income at the conclusion of the 18 month escrow period.

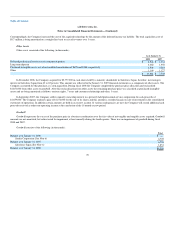

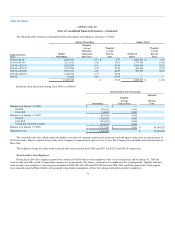

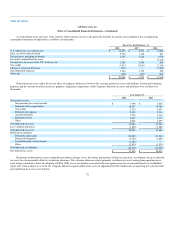

Goodwill

Goodwill represents the excess of the purchase price in a business combination over the fair value of net tangible and tangible assets acquired. Goodwill

amounts are not amortized, but rather tested for impairment at least annually during the fourth quarter. There was no impairment of goodwill during fiscal

2008 and 2007.

Goodwill consists of the following (in thousands):

Total

Balance as of January 31, 2006 $ —

Sendia Corporation (See Note 6) 6,705

Balance as of January 31, 2007 6,705

Salesforce Japan (See Note 6) 1,851

Balance as of January 31, 2008 $8,556

70