Salesforce.com 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

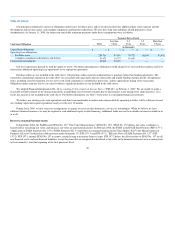

Table of Contents

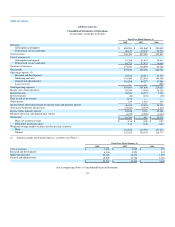

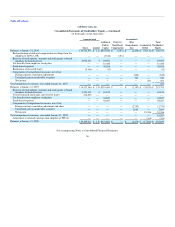

Our principal commitments consist of obligations under leases for office space and co-location facilities for additional data center capacity and the

development and test data center, and computer equipment and furniture and fixtures. We also have long-term liabilities related primarily to lease

abandonments. At January 31, 2008, the future non-cancelable minimum payments under these commitments were as follows:

Payments Due by Period

Contractual Obligations Total

Less than

1 Year

1-3

Years

3-5

Years

More than

5 Years

(in thousands)

Capital lease obligations $ 7 $ 7 $ — $ — $ —

Operating lease obligations:

Facilities space 259,754 47,501 79,772 68,549 63,932

Computer equipment and furniture and fixtures 53,475 34,577 18,898 — —

Contractual commitments 23,972 23,972 — — —

Our lease agreements provide us with the option to renew. Our future operating lease obligations would change if we exercised these options and if we

entered into additional operating lease agreements as we expand our operations.

Purchase orders are not included in the table above. Our purchase orders represent authorizations to purchase rather than binding agreements. The

contractual commitment amounts in the table above are associated with agreements that are enforceable and legally binding and that specify all significant

terms, including: fixed or minimum services to be used; fixed, minimum or variable price provisions; and the approximate timing of the transaction.

Obligations under contracts that we can cancel without a significant penalty are not included in the table above.

We adopted Financial Interpretation No. 48, Accounting for Uncertainty in Income Taxes, ("FIN 48") on February 1, 2007. We are unable to make a

reasonably reliable estimate of the timing of payments in individual years beyond 12 months due to uncertainties in the timing of tax audit outcomes. As a

result, this amount is not included in the table above. For further information, see Note 7 to the notes to consolidated financial statements.

We believe our existing cash, cash equivalents and short-term marketable securities and cash provided by operating activities will be sufficient to meet

our working capital and capital expenditure needs over the next 12 months.

During fiscal 2009, we may enter into arrangements to acquire or invest in other businesses, services or technologies. While we believe we have

sufficient financial resources, we may be required to seek additional equity or debt financing. Additional funds may not be available on terms favorable to us

or at all.

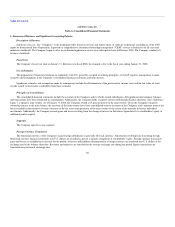

Recent Accounting Pronouncements

In September 2006, the FASB issued SFAS No. 157, "Fair Value Measurements" (SFAS No. 157). SFAS No. 157 defines fair value, establishes a

framework for measuring fair value, and enhances fair value measurement disclosure. In February 2008, the FASB issued FASB Staff Position (FSP) 157-1,

"Application of FASB Statement No. 157 to FASB Statement No. 13 and Other Accounting Pronouncements That Address Fair Value Measurements for

Purposes of Lease Classification or Measurement under Statement 13" (FSP 157-1) and FSP 157-2, "Effective Date of FASB Statement No. 157" (FSP

157-2). FSP 157-1 amends SFAS No. 157 to remove certain leasing transactions from its scope. FSP 157-2 delays the effective date of SFAS No. 157 for all

non-financial assets and non-financial liabilities, except for items that are recognized or disclosed at fair value in the financial statements on a recurring basis

(at least annually), until the beginning of the first quarter of fiscal

48