Salesforce.com 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

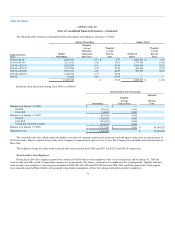

Notes to Consolidated Financial Statements—(Continued)

increase in the liability for unrecognized tax benefits, with a corresponding increase to the accumulated deficit balance. If recognized, $5.7 million of the

unrecognized tax benefits would reduce the Company's income tax expense and effective tax rate. Upon adoption of Interpretation 48 the Company also

reclassified $4.1 million of current income taxes payable to noncurrent income taxes payable since the Company cannot reasonably estimate the period of

cash settlement, if any, with various taxing authorities.

The Company recognizes interest accrued and penalties related to unrecognized tax benefits in its tax provision. As of January 31, 2008, the Company

accrued no penalties and an immaterial amount of interest in income tax expense.

Tax positions for the Company and its subsidiaries are subject to income tax audits by many tax jurisdictions throughout the world. Tax returns for all

tax years since February 1999, which was the inception of the Company, remain open to examination in all major jurisdictions where the Company operates,

including the United States, Canada, United Kingdom, Japan and Australia. During the quarter ended January 31, 2008, the Internal Revenue Service initiated

an examination of the Company's federal income tax return for the fiscal year ended January 31, 2006. This audit may possibly be completed within the next

12 months. While it is often difficult to predict the final outcome of any particular uncertain tax position, management does not believe that it is reasonably

possible that the estimates of unrecognized tax benefits will change significantly in the next twelve months.

Revenue Recognition

The Company derives its revenues from two sources: (1) subscription revenues, which are comprised of subscription fees from customers accessing its

on-demand application service, and from customers purchasing additional support beyond the standard support that is included in the basic subscription fee;

and (2) related professional services and other revenue. Other revenues consist primarily of training fees. Because the Company provides its application as a

service, the Company follows the provisions of the Securities and Exchange Commission's, or SEC, Staff Accounting Bulletin No. 104, Revenue Recognition

and Emerging Issues Task Force Issue No. 00-21, Revenue Arrangements with Multiple Deliverables. The Company recognizes revenue when all of the

following conditions are met:

• There is persuasive evidence of an arrangement;

• The service has been provided to the customer;

• The collection of the fees is reasonably assured; and

• The amount of fees to be paid by the customer is fixed or determinable.

The Company's arrangements do not contain general rights of return.

Subscription and support revenues are recognized ratably over the contract terms beginning on the commencement date of each contract. Amounts that

have been invoiced are recorded in accounts receivable and in deferred revenue or revenue, depending on whether the revenue recognition criteria have been

met.

Professional services and other revenues, when sold with subscription and support offerings, are accounted for separately when these services have

value to the customer on a standalone basis and there is objective and reliable evidence of fair value of each deliverable. When accounted for separately,

revenues are recognized as the services are rendered for time and material contracts, and when the milestones are achieved and accepted by the customer for

fixed price contracts. The majority of the Company's consulting contracts are on a time and material basis. Training revenues are recognized after the services

are performed. For revenue arrangements with multiple deliverables, such as an arrangement that includes subscription, premium support, consulting or

training services, the Company allocates the total amount the customer will pay to the separate units of accounting based on their relative fair values, as

determined by the price of the undelivered items when sold separately.

63