Salesforce.com 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

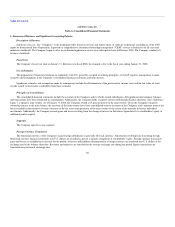

2010. The measurement and disclosure requirements related to financial assets and financial liabilities are effective for us beginning in the first quarter of

fiscal 2009. The adoption of SFAS No. 157 for financial assets and financial liabilities will not have a significant impact on our consolidated financial

statements. However, the resulting fair values calculated under SFAS No. 157 after adoption may be different from the fair values that would have been

calculated under previous guidance. We are currently evaluating the impact that SFAS No. 157 will have on our consolidated financial statements when it is

applied to non-financial assets and non-financial liabilities beginning in the first quarter of 2010.

In December 2007, the FASB issued SFAS No. 160, "Noncontrolling Interests in Consolidated Financial Statements—an amendment of Accounting

Research Bulletin No. 51" ("SFAS 160"). SFAS 160 establishes accounting and reporting standards for ownership interests in subsidiaries held by parties

other than the parent, the amount of consolidated net income attributable to the parent and to the noncontrolling interest, changes in a parent's ownership

interest and the valuation of retained noncontrolling equity investments when a subsidiary is deconsolidated. SFAS 160 also establishes disclosure

requirements that clearly identify and distinguish between the interests of the parent and the interests of the noncontrolling owners. SFAS 160 is effective as

of the beginning of an entity's fiscal year that begins after December 15, 2008, and will be adopted by us in the first quarter of fiscal 2010. We are currently

evaluating the potential impact, if any, of the adoption of SFAS 160 on our consolidated results of operations and financial condition.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

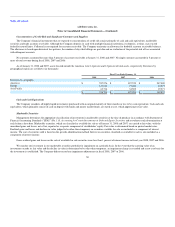

Foreign currency exchange risk

Our results of operations and cash flows are subject to fluctuations due to changes in foreign currency exchange rates, particularly changes in the Euro,

British Pound Sterling, Canadian dollar, Japanese Yen and Australian dollar. We seek to minimize the impact of certain foreign currency fluctuations by

hedging certain balance sheet exposures with foreign currency forward and option contracts. Any gain or loss from settling these contracts is offset by the loss

or gain derived from the underlying balance sheet exposures. The hedging contracts by policy have maturities of less than three months and settle before the

end of each quarterly period. Additionally, by policy, we do not enter into any hedging contracts for trading or speculative purposes.

Interest rate sensitivity

We had cash, cash equivalents and marketable securities totaling $669.8 million at January 31, 2008. These amounts were invested primarily in money

market funds and instruments, corporate notes and bonds, government securities and other debt securities with credit ratings of at least single A or better. The

cash, cash equivalents and short-term marketable securities are held for working capital purposes. Our investments are made for capital preservation purposes.

We do not enter into investments for trading or speculative purposes.

Our fixed-income portfolio is subject to interest rate risk. An immediate increase or decrease in interest rates of 100-basis points could result in a $3.2

million market value reduction or increase of the same amount. This estimate is based on a sensitivity model that measures market value changes when

changes in interest rates occur. Fluctuations in the value of our investment securities caused by a change in interest rates (gains or losses on the carrying

value) are recorded in other comprehensive income, and are realized only if we sell the underlying securities.

At January 31, 2007, we had cash, cash equivalents and marketable securities totaling $412.5 million. The fixed-income portfolio was also subject to

interest rate risk. Changes in interest rates of 100-basis points would have resulted in market value changes of $2.8 million.

49