Salesforce.com 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

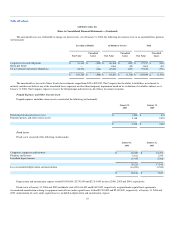

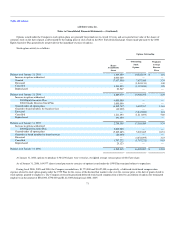

Future minimum lease payments under noncancelable operating and capital leases are as follows (in thousands):

Capital

Leases

Operating

Leases

Fiscal Year Ended January 31:

2007 $ 638 $ 41,280

2008 180 31,442

2009 7 20,544

2010 — 9,654

2011 — 9,631

Thereafter — 13,302

Total minimum lease payments 825 $ 125,853

Less: amount representing interest (26)

Present value of capital lease obligations $ 799

The terms of the lease agreements provide for rental payments on a graduated basis. The Company recognizes rent expense on the straight-line basis

over the lease period and has accrued for rent expense incurred but not paid. Of the total operating lease commitment balance of $125.9 million, $76.6 million

is related to facilities space. The remaining $49.3 million commitment is related computer equipment and other leases.

Our agreements for the facilities and certain services provide us with the option to renew. Our future contractual obligations would change if we

exercised these options.

Rent expense for fiscal 2006, 2005 and 2004 was $11,434,000, $6,490,000 and $4,686,000, respectively.

In December 2001, the Company abandoned 19,500 square feet of excess office space in San Francisco and recorded a lease abandonment charge of

$7,657,000. This amount consisted of the future rent obligations under the operating leases of $11,368,000, offset by projected subtenant income of

$3,711,000.

Of the total space abandoned, the Company subleased 7,500 square feet through the remaining term of its operating lease at the original sublease

assumptions. Additionally, in August 2003, the Company executed a Third Amendment to Office Lease with its landlord. This agreement modified the

original lease such that the total leased space under the amended agreement excluded 7,200 square feet of the space that was abandoned. As a result of this

amendment, the Company recorded a reduction in its lease liability of $4,342,000 during the third quarter of fiscal 2004.

At January 31, 2004, approximately 5,000 square feet of the 19,500 square feet of office space abandoned in December 2001 remained available for

sublease. The operating lease for this remaining space expires in April 2011. Due to the difficulty in securing subtenants to occupy the remaining 5,000 square

feet of available office space, the Company lowered its subtenant income assumptions and recorded an additional $897,000 lease abandonment charge in its

fourth quarter of fiscal 2004 operating results.

During fiscal 2005, the Company subleased 700 square feet of available space. At January 31, 2005, the remaining liability associated with

approximately 4,000 remaining square feet of office space abandoned in December 2001 was $1,531,000 and consisted of the future rental obligation offset

by an estimate of projected subtenant income of $919,000.

In March 2005, the Company entered into an agreement with its primary landlord that released it from a portion of the future obligations associated

with the remaining 4,000 square feet of San Francisco office space

74