Salesforce.com 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238

|

|

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

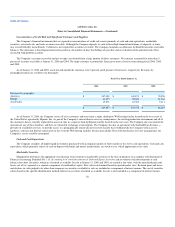

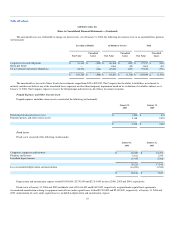

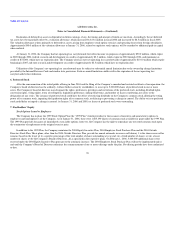

Other Assets

Other assets consisted of the following (in thousands):

January 31,

2006

January 31,

2005

Capitalized internal-use software development costs, net of accumulated amortization of $1,400 and $957, respectively $ 1,550 $ 641

Deferred professional service costs, noncurrent portion 486 —

Long-term deposits 1,542 1,138

Other 206 —

$ 3,784 $ 1,779

Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consisted of the following (in thousands):

January 31,

2006

January 31,

2005

Accrued compensation $ 24,465 $ 16,836

Accrued other liabilities 10,844 6,560

Current portion of lease abandonment liability 186 278

Liability for early exercise of unvested employee stock options 229 591

Accrued non-income taxes payable 7,463 5,146

Accrued professional costs 1,911 2,241

Accrued rent 3,684 815

$ 48,782 $ 32,467

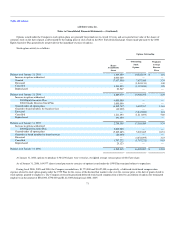

4. Initial Public Offering

In June 2004, the Company completed the sale of 11,500,000 shares of common stock, which included the underwriters' exercise of an over-allotment

option, at a price of $11.00 per share. A total of $126,500,000 in gross proceeds was raised in this initial public offering. After deducting the underwriting

discount of $8,855,000 and offering expenses of $3,877,000, net proceeds were $113,768,000. To date, the Company has not spent any of the net proceeds

from the public offering.

Upon the closing of the Company's initial public offering, the 58,024,345 shares of the Company's outstanding convertible preferred stock converted,

on a one-for-one basis, into shares of common stock.

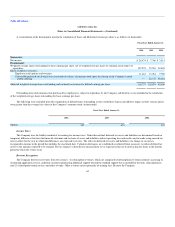

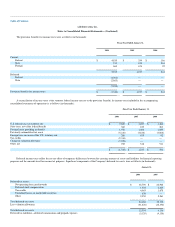

5. Income Taxes

The domestic and foreign components of income (loss) before provisions for income taxes and minority interest were as follows (in thousands):

Fiscal Year Ended January 31,

2006

2005

2004

Domestic $ 31,240 $ 12,509 $ 9,550

Foreign (3,042) (3,356) (5,311)

$ 28,198 $ 9,153 $ 4,239

68