Salesforce.com 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

outside service costs was due to the cost of being a public company and the added costs of managing a growing business and expanding outside the United

States.

Lease Recovery. The lease recovery of $3.4 million during fiscal 2004 was due to the reduction in accruals associated with the San Francisco, California

office space that we abandoned in December 2001. In August 2003, we entered into an agreement, releasing us from future obligations for some of the space

abandoned, in connection with the landlord's lease of this space to another tenant. Accordingly, we recorded a $3.4 million credit to reflect the reversal of the

accrual that was directly related with this space.

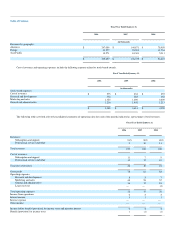

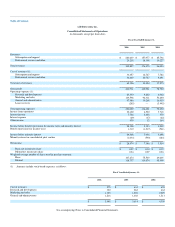

Operating Income. Operating income during fiscal 2005 was $6.5 million. During fiscal 2004, it was $3.7 million, substantially all of which consisted

of the lease recovery described above. The increase in operating income was primarily due to the increase in revenues, most of which was re-invested in an

effort to expand our business.

Interest Income. Interest income substantially consists of investment income on cash and marketable securities balances and also includes interest

income on outstanding loans made to individuals who early exercised their stock options. None of these individuals was an executive officer or director of the

Company and all of them repaid their loan balances by February 28, 2005. Interest income was $2.7 million during fiscal 2005 and was $379,000 during fiscal

2004. The increase was primarily due to increased marketable securities balances resulting from the proceeds from the sale of our common stock in our initial

public offering in June 2004.

Provision for Income Taxes. We recorded a provision for income tax expense of $1.2 million for fiscal 2005 as compared to a provision for income tax

expense of $541,000 for fiscal 2004. The fiscal 2005 provision for income taxes consists of amounts accrued for our estimated domestic federal alternative

minimum tax and state income tax liability as well as an estimate of our foreign income tax expense.

Liquidity and Capital Resources

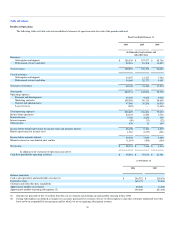

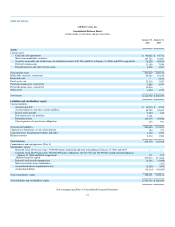

At January 31, 2006, our principal sources of liquidity were cash, cash equivalents and marketable securities totaling $296.8 million and accounts

receivable of $76.1 million.

Net cash provided by operating activities was $95.9 million during the year ended January 31, 2006 and $55.9 million during the same period a year

ago. The improvement in cash flow was due primarily to the increased number of paying subscribers to our service. Cash provided by operating activities has

historically been affected by sales of subscriptions and support and professional services, changes in working capital accounts, particularly increases in

accounts receivable and deferred revenue and the timing of commission and bonus payments, and add-backs of non-cash expense items such as depreciation

and amortization and the expense associated with stock-based awards.

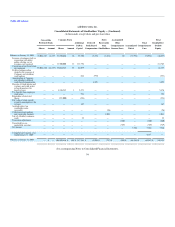

Net cash used in investing activities was $47.8 million during the year ended January 31, 2006 and $149.2 million during the same period a year ago,

which included the investment of most of the proceeds from our initial public offering in June 2004. The net cash used in investing activities during the year

ended January 31, 2006 primarily related to the changes in restricted cash balances and marketable securities and capital expenditures associated with the

purchase of software licenses, computer equipment and furniture and fixtures as we have expanded our infrastructure and work force.

In February 2005, we obtained additional software licenses for use in our business operations at a cost of $8.8 million, which included the cost for

support for the first year of the license agreement. Additionally, we obtained additional data center capacity and we upgraded our new development and test

data center. For these data center resources, our principal commitments consist of obligations under operating leases for the facilities and computer equipment

and contracts for certain services.

45