Salesforce.com 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

commission charges are so closely related to the revenue from the noncancelable customer contracts that they should be recorded as an asset and charged to

expense over the same period that the subscription revenue is recognized.

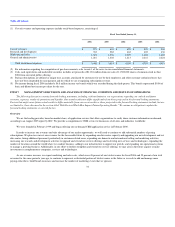

During fiscal 2006, we deferred $22.1 million of commission expenditures and we amortized $14.6 million to sales expense. During the same period a

year ago, we deferred $14.0 million of commission expenditures and we amortized $15.6 million to sales expense. Deferred commissions on our consolidated

balance sheet totaled $17.1 million at January 31, 2006 and $9.6 million at January 31, 2005.

Accounting for Stock-Based Awards. We recorded deferred stock-based compensation charges in the amount by which the exercise price of an option is

less than the deemed fair value of our common stock at the date of grant. We have elected not to record stock-based compensation expense when employee

stock options are awarded at exercise prices equal to the deemed fair value of our common stock at the date of grant. Prior to the establishment of a public

market for our stock in June 2004, our board of directors determined the fair value of our common stock based upon several factors, including, but not limited

to, our operating and financial performance, private sales of our common and preferred stock between third parties, issuances of convertible preferred stock

and appraisals performed by an appraisal firm. The fair value of our common stock is now determined by the trading price of our stock on the New York

Stock Exchange.

We amortize the deferred compensation charges ratably over the four-year vesting period of the underlying option awards. As of January 31, 2006, we

had an aggregate of $2.5 million of deferred stock-based compensation remaining to be amortized.

On February 1, 2006, which is the start of our fiscal 2007, we will begin to recognize in our consolidated statement of operations the cost of employee

stock options in accordance with Statement of Financial Accounting Standards No. 123 (revised 2004), Share-Based Payment, or SFAS 123R (see Recent

Accounting Pronouncement below for further discussion). We believe that the adoption of SFAS 123R will materially reduce our fiscal 2007 reported results

of operations.

In the past, we have awarded a limited number of stock options and warrants to non-employees. For these options and warrants, we recognize stock-

based compensation expense over the vesting periods of the underlying awards, based on an estimate of their fair value on the vesting dates using the Black-

Scholes option-pricing model. As of January 31, 2006, we had recognized compensation expense on all options and warrants issued to non-employees except

for options for 50,000 shares of our common stock, all of which will fully vest by July 2007 and have an exercise price of $2.50 per share.

Accounting for Income Taxes. We account for income taxes using the liability method, which requires the recognition of deferred tax assets or liabilities

for the tax-effected temporary differences between the financial reporting and tax bases of our assets and liabilities and for net operating loss and tax credit

carryforwards. The tax expense or benefit for unusual items, tax exposure items or adjustments to the valuation allowance are treated as discrete items in the

interim period in which the events occur.

Prior to fiscal 2006, we recorded a full valuation allowance to reserve for the benefit of our deferred tax assets due to the uncertainty surrounding our

ability to realize these assets. During fiscal 2006, we recorded an income tax benefit of $1.3 million, which included a partial reversal of the valuation

allowance related to certain of our deferred tax assets. The Company continues to maintain a $41.8 million valuation allowance against the deferred tax assets

attributable to employee stock option exercises and operating losses from certain foreign subsidiaries. Future reductions in the valuation allowance related to

employee stock option activity, which was approximately $40.0 million of the total valuation allowance as of January 31, 2006, will be recorded to additional

paid-in capital.

38