Porsche 2013 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2013 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Amortization and depreciation across all functions increased

to 1,415 million euro compared to 1,114 million euro in

the prior year. This increase mainly pertains to amortization

of development costs and depreciation of tools that are

disclosed under other equipment, furniture and fixtures.

Depreciation of leased assets likewise increased significantly.

Other operating income increased from 547 million euro

to 610 million euro. The increase is mainly attributable to

increased income from the reversal of provisions and accru-

als. Other operating expenses decreased from 461 million

euro to 351 million euro. The decrease mainly results from

lower expenses in connection with currency options.

Operating profit came to 2,579 million euro, increasing by

150 million euro in comparison to the prior year.

The financial result comes to 205 million euro (prior year:

209 million euro). Finance costs fell due to the improvement

in average net liquidity and the improved refinancing terms.

However, the decrease was also compensated for by

increased expenses (prior year: income) from the fair-value

measurement of derivative exchange rate and interest rate

hedges that are not included in hedge accounting.

The healthy cost structure and the sustainably high earnings

power of the group are also reflected in the key performance

indicators. The Porsche AG group achieved a return on sales

of 18 percent in the past fiscal year (prior year: 18 percent).

The return on sales net of tax was 19 percent (prior year:

19 percent). The return on capital, defined as the ratio of

operating result net of tax to average invested assets of

the automotive division, was 30 percent (prior year: 33 per-

cent). The return on equity net of tax was 24 percent (prior

year: 25 percent).

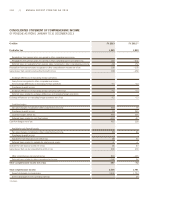

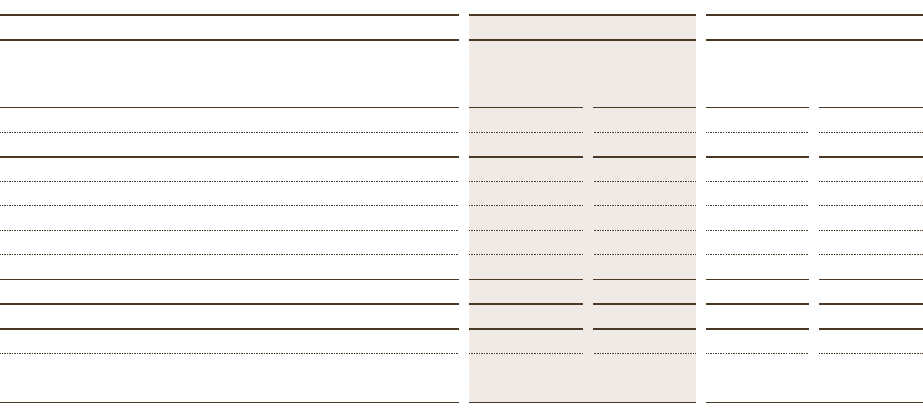

FY 2013 FY 2012 1)

€ million % € million %

Revenue 14,326 100 13,865 100

Cost of sales – 10,139 – 71 – 9,755 – 70

Gross prot 4,187 29 4,110 30

Distribution expenses – 1,075 – 7 – 1,014 – 7

Administrative expenses – 792 – 5 – 753 – 5

Other operating income 610 4 547 4

Other operating expenses – 351 – 3 – 461 – 4

Operating prot 2,579 18 2,429 18

Financial result 205 1 209 1

Prot before tax 2,784 19 2,638 19

Income tax – 845 – 5 – 805 – 6

Prot after tax 1,939 14 1,833 13

1) Restated.

RESULTS OF OPERATIONS OF THE PORSCHE AG GROUP

FINANCIAL ANALYSIS // 115