Porsche 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

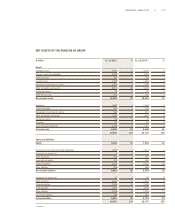

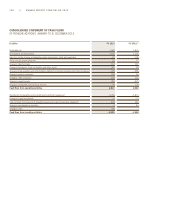

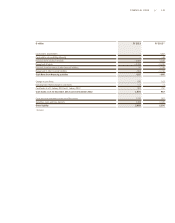

As of 31 December 2013, the total assets of the Porsche AG

group stood at 24,560 million euro, 8 percent higher than

on the prior-year reporting date.

Non-current assets increased by 311 million euro to

18,392 million euro. The absolute increase relates

mainly to fixed assets. This was counterbalanced in other

receivables and assets by a decrease in non-current loan

receivables. Non-current assets expressed as a percentage

of total assets amounted to 75 percent (prior year:

79 percent).

At the end of the reporting period, the fixed assets of the

Porsche AG group – i.e., the intangible assets, property,

plant and equipment, leased assets and financial assets

– came to 8,539 million euro (prior year: 7,083 million

euro). Fixed assets expressed as a percentage of total

assets increased to 35 percent (prior year: 31 percent).

Intangible assets increased from 2,179 million euro to

2,590 million euro. The increase mainly relates to capital-

ized development costs. The largest additions pertain to

the Macan, Carrera and Panamera model series. Property,

plant and equipment increased in comparison to the prior

year by 625 million euro to 3,935 million euro, primarily

due to additions to other equipment, furniture and fixtures,

and land and buildings. These additions mainly relate to

construction measures in Leipzig and to tool for the new

Macan model series and new vehicle generations. Leased

assets increased by 322 million euro in comparison to the

prior year to 1,708 million euro. This item contains vehi-

cles leased to customers under operating leases.

NET ASSETS, FINANCIAL POSITION

AND RESULTS OF OPERATIONS

NET ASSETS Non-current other receivables and assets decreased by

1,018 million euro, primarily as a result of the change to

the remaining term of a formerly non-current loan receivable.

Loan receivables of 1,177 million euro are presented under

other receivables as of the reporting date.

Deferred tax assets totaled 165 million euro compared to

203 million euro in the prior year.

As a percentage of total assets, current assets amount to

25 compared to 21 percent in the prior year. Inventories in-

creased from 1,239 million euro in the prior year to 1,589

million euro at the end of the reporting period. In compar-

ison to the prior reporting date, there was an increase of

approx. 4,000 units in new vehicle inventories.

Non-current and current receivables from financial services

fell from 1,703 million euro to 1,550 million euro, primarily

as a result of the realignment of the financial services busi-

ness in the UK and on account of the increase in percent-

age of operating lease agreements in the German market.

This item mainly contains receivables from finance leases

and receivables from customer and dealer financing.

Current other receivables and assets rose by 502 million

euro to 1,933 million euro. The increase in current loan

receivables is countered by a decrease in the clearing

account with Porsche Holding Stuttgart

FINANCIAL ANALYSIS // 111