Office Depot 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

66 |Office Depot 2004 Annual Report

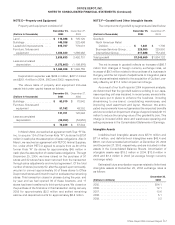

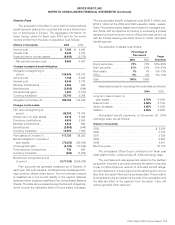

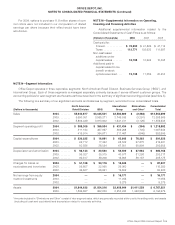

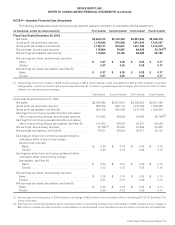

Senior management evaluates the performance of each business segment based on segment operating profit, which is defined

as sales less cost of goods sold, and store and warehouse operating expenses. General and administrative expenses, financing

costs and certain other items currently are not allocated to the business segments because they are viewed as corporate functions

that support all activities. A reconciliation of the measure of segment operating profit to consolidated earnings from continuing oper-

ations before income taxes follows.

(Dollars in thousands) 2004 2003 2002

Segment operating profit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,218,882 $1,067,634 $992,606

(Add)/subtract:

General and administrative expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 665,825 578,840 486,279

Other operating expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23,080 22,809 9,855

Interest expense, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41,066 40,609 27,686

Loss on extinguishment of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45,407 ——

Miscellaneous income, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (17,729) (15,392) (7,183)

Earnings from continuing operations before income taxes and

cumulative effect of accounting change . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 461,233 $ 440,768 $475,969

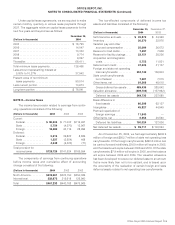

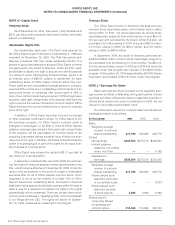

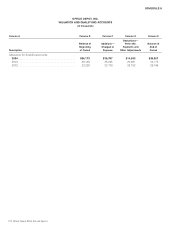

We sell office products and services through either wholly owned operations or through joint ventures or licensing arrangements,

in Austria, Belgium, Canada, Costa Rica, El Salvador, France, Germany, Guatemala, Hungary, Ireland, Israel, Italy, Japan,

Luxembourg, Mexico, the Netherlands, Poland, Portugal, Spain, Switzerland, Thailand, the United Kingdom and the United States.

There is no single country outside of the United States in which we generate 10% or more of our total revenues. Geographic finan-

cial information relating to our business is as follows (in thousands).

Sales Property and Equipment

2004 2003 2002 2004 2003

United States . . . . . . . . . . . . . . . . . . . . . . $ 9,846,856 $ 9,469,563 $ 9,575,457 $1,055,460 $ 891,305

International . . . . . . . . . . . . . . . . . . . . . . . 3,717,843 2,889,003 1,781,176 407,568 402,450

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . $13,564,699 $12,358,566 $11,356,633 $1,463,028 $1,293,755

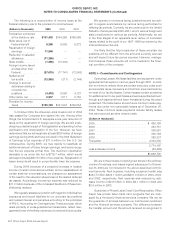

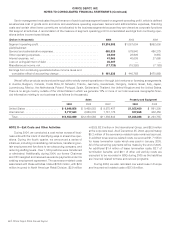

NOTE O—Exit Costs and Other Activities

During 2004, we conducted a cost review across all busi-

ness units with the intent of identifying ways to streamline oper-

ations. During the fourth quarter, we announced a series of

initiatives, including consolidating call centers, transferring cer-

tain employees and functions to an outsourcing company, and

reducing staffing levels. Over 1,500 positions were transferred

or eliminated. Additionally, during 2004, our former Chairman

and CEO resigned and received severance payments under his

existing employment agreement. The severance-related costs

associated with these activities totaled $16.6 million, with $2.0

million incurred in North American Retail Division, $2.9 million

in BSG, $2.8 million in the International Group, and $8.9 million

at the corporate level. As of December 25, 2004, approximately

$5.2 million of the severance-related costs remained accrued.

In addition to severance-related costs, we accrued $1.7 million

for lease termination costs which was paid in January 2005.

All of the remaining payments will be made by the end of 2005.

An additional $1.4 million of lease termination costs, $2.7 of

termination benefits, and $6.1 of other exit activity costs are

expected to be recorded in BSG during 2005 as the liabilities

are incurred related to these announced programs.

During 2004, we also relocated one warehouse in Europe

and incurred exit related costs of $13.9 million.