Office Depot 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$4.3 million in 2004. In 2003, we sold or abandoned a majority

of our interest in certain Internet companies, resulting in a fourth

quarter charge of $8.4 million. In 2002 we recorded charges of

$3.0 million related to the impairment of these investments. In

2003, this category also included recognition of approximately

$11.8 million of net foreign currency gains, primarily resulting

from holding euro investments in anticipation of purchasing

Guilbert in June 2003.

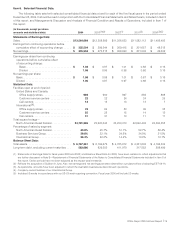

Income Taxes

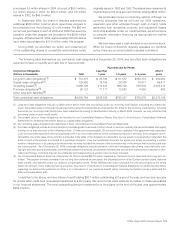

(Dollars in thousands) 2004 2003 2002

Income Taxes . . . . . . . . . $125,729 $141,524 $166,554

Effective income

tax rate* . . . . . . . . . . . 27% 32% 35%

*Income Taxes as a percentage of earnings from continuing opera-

tions before income taxes.

The effective income tax rate in 2004 has been affected by

four significant factors: (1) an $11.5 million tax expense related

to the anticipated repatriation of foreign earnings, (2) an $11.3

million tax benefit from reducing existing valuation allowances

on deferred tax assets, (3) settlements of tax audits of $12.4

million, and (4) a release of previously recorded accruals for

uncertain tax positions based on changes in the facts and

circumstances.

The American Jobs Creation Act was passed by Congress

and signed into law in 2004. This Act allows a one-time reduc-

tion in U.S. Federal taxes on repatriated earnings of foreign

affiliates. We have decided to repatriate at least $200 million of

foreign earnings and have recognized the incremental U.S. tax

expense. We have not yet decided whether to repatriate any

additional amounts. Should we decide to bring additional for-

eign earnings back to the U.S. during 2005, our tax expense will

increase accordingly.

Because of a projected increase in taxable income of cer-

tain international entities, and a reassessment of certain state

tax circumstances, we changed our assessment of the need for

the valuation allowances on the related deferred tax assets.

Tax expense was reduced because we now believe the related

tax benefits are more likely than not to be realized.

The consolidated effective income tax rate has decreased

over the three years presented, reflecting an increasing pro-

portion of international activity, which is generally taxed at lower

effective tax rates and, in 2003, realization of certain state tax

credits. The effective tax rate in future periods can be affected

by variability in our mix of income and tax rates in the various

jurisdictions and therefore may be higher or lower than it has

been over the past three years. Currently, we are in the final

stages of completing routine taxing authority examinations of

certain earlier tax years. Resolution of these examinations for

amounts other than those that we have reserved as probable

exposures will impact tax expense in future periods.

We are a multi-national corporation engaged in complex

business, legal and tax transactions in various countries. Our

current effective tax rate is dependent in part upon both agree-

ments with taxing authorities in a number of jurisdictions and tax

filing positions taken in various jurisdictions, which tax filing

positions we believe to have been taken in good faith and to be

well founded based upon our understanding of the applicable

tax codes. Our agreements with tax authorities and our tax filing

positions are subject to ongoing review by us and by various

taxing authorities. A material change in any of our agreements

with taxing authorities, or a successful challenge to any one or

more of our tax filing positions, could have a material impact on

our overall corporate tax rate, causing this rate to be higher or

lower than the current tax rate.

In 2005, we anticipate resolution of various issues pertain-

ing to certain tax agreements and/or tax filing positions in var-

ious taxing jurisdictions, which could result in a higher effective

tax rate. Such change in our tax rate could be material. We have

made no determination at this time as to whether there will def-

initely be a change in our tax rate, the magnitude of any such

change in our tax rate or the impact on future periods from any

such change.

Liquidity and Capital Resources

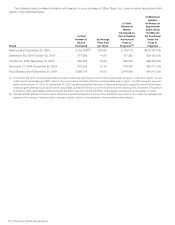

Cash provided by (used in) our operating, investing and

financing activities is summarized as follows:

(Dollars in thousands) 2004 2003 2002

Operating activities . . . $ 645,865 $ 656,280 $ 702,334

Investing activities . . . . (426,606) (1,184,377) (199,903)

Financing activities . . . (256,477) 388,851 (212,625)

Operating Activities

We have consistently satisfied operating liquidity needs

and planned capital expenditure programs through our normal

conversion of sales to cash. Over the three years ended in

2004, we generated over $2.0 billion of cash flows from oper-

ating activities. At December 25, 2004, we had over $565 mil-

lion available under our revolving credit facility, and incurred no

new borrowings under this program during this year, in spite of

significant outflows for investing and financing activities.

Our major sources of cash from operations include: store

sales, a majority of which are generated on a cash and carry

basis, our private label credit card program, which is adminis-

tered by a third party financial services company and con-

verted to cash daily, and collection of our receivables. We

generate receivables from our contract and certain direct mail

customers, and as we expand this business here and abroad,

we anticipate our accounts receivable portfolio will grow.

Additionally, amounts due us under rebate, cooperative adver-

tising, and other programs with our vendors comprised over

25% of total receivables at the end of 2004 and 2003, respec-

tively. These receivables tend to fluctuate seasonally (growing

during the second half of the year and declining during the

first half), because certain collections do not occur until spec-

ified milestones are reached or the program year is complete.

These receivables, however, are typically high quality and

are collected quickly after reaching specified milestones. Our

primary outflow of cash from operations is the purchase of

inventory, net of customary credit arrangements with vendors,

operational costs such as payroll and rent, and the payment of

current taxes.

Office Depot 2004 Annual Report |27