Office Depot 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 |Office Depot 2004 Annual Report

Corporate and Other

Other Operating Expenses

Other operating expenses primarily reflect pre-opening

expenses and, in 2003, costs related to the integration

of Guilbert.

Pre-opening expenses consist of personnel, property and

advertising expenses incurred in opening or relocating stores

and customer service centers (“CSCs”). We typically incur pre-

opening expenses during a six-week period prior to a store

opening, but the period was longer in 2004 for some of the

stores acquired in the transaction with Toys “R” Us. Because

we expense these items as they are incurred, the amount of

pre-opening expenses each year is generally proportional to the

number of new stores and CSCs opened during the period. On

a world-wide basis, we opened or relocated 103 stores in 2004,

64 in 2003, and 42 in 2002. We relocated one CSC in Europe

during 2004 and expect to complete another relocation dur-

ing 2005. We opened three CSCs in 2002. For 2004, our pre-

opening expenses were approximately $190,000 per domestic

office supply store and $75,000 per international office supply

store. Our cost to open a new CSC varies significantly with the

size and location of the facility. We estimate pre-opening costs

to open a domestic or international CSC to be approximately

$1.0 million per facility.

In 2003, we incurred approximately $17.7 million of non-

capitalizable integration costs in connection with our acquisition

of Guilbert in June 2003. These costs primarily related to pro-

fessional consulting fees for assistance with integration, man-

agement, internal communications plans, and human resource

aspects of the acquisition.

General and Administrative Expenses

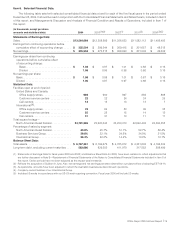

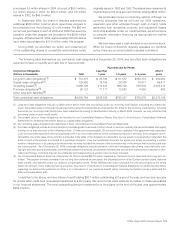

(Dollars in thousands) 2004 2003 2002

General and

administrative

expenses . . . . . . . . . . $665,825 $578,840 $486,279

Percentage of sales . . . . 4.9% 4.7% 4.3%

Our general and administrative (“G&A”) expenses prima-

rily consist of personnel-related costs associated with global

support functions. Because these functions typically support all

segments of our business, we have not considered these costs

in determining our segment profitability.

The increase during 2004 includes a full year of Guilbert-

related G&A expenses, as well as the impact of translating all

international G&A expenses at higher exchange rates. The

increase as a percentage of sales, however, reflects the write

off of costs associated with terminating plans for a new cor-

porate office site, dispute resolutions, executive severance

following the departure of our Chairman and CEO, exit costs

associated with corporate staff reductions, additional profes-

sional fees to comply with new legislation requiring additional

documentation of controls over financial reporting, and corpo-

rate systems enhancements.

The increase in 2003 reflects the mid-year acquisition of

Guilbert, the impact of exchange rates on other international

expenses, and costs relating to finance, human resources and

merchandising software applications. Employee-related costs

declined in 2003 because of lower performance-based com-

pensation, partially offset by higher costs for healthcare and

other employee benefits.

The comments above and in the Overall section of this

MD&A describe how our management has historically pre-

sented our G&A expenses. Other companies may charge more

or less G&A expenses and other costs to their segments, and

our results therefore may not be comparable to similarly titled

measures used by other entities.

Other Income and Expense

(Dollars in thousands) 2004 2003 2002

Interest income. . . . . . . . $ 20,042 $ 14,196 $ 18,509

Interest expense. . . . . . . (61,108) (54,805) (46,195)

Loss on extinguishment

of debt . . . . . . . . . . . . (45,407) ——

Miscellaneous income,

net. . . . . . . . . . . . . . . . 17,729 15,392 7,183

Interest income increased in 2004, reflecting higher aver-

age cash and cash equivalent balances and higher interest-

based investment yields. The decrease in 2003 reflects lower

interest rates and lower cash balances for part of the year fol-

lowing the acquisition of Guilbert in mid-2003.

The increase in interest expense over the three-year period

ended in 2004 results from the change in borrowings out-

standing by period. Fiscal year 2004 includes interest on a

full year of $400 million in senior notes that were issued in

August 2003 at an effective interest rate of 5.87%, essentially a

full year of interest on the $250 million in senior subordinated

notes with an effective interest rate of 8.7% that were redeemed

in December 2004, a full year of interest on approximately $100

million outstanding under our revolving credit facility, as well

as interest expense on capital leases. Interest expense also

includes accretion on lease obligations for stores closed before

the end of 2002; the accrued lease obligations totaled $58.8 mil-

lion at December 25, 2004. Following a change in accounting

rules, accretion on lease obligations for stores closed after Jan-

uary 2003 is included as a component of operating expenses.

In December 2004, we redeemed the entire issue of the

$250 million senior subordinated notes, pursuant to the optional

redemption provisions of the subordinated notes indenture. The

payment of approximately $302 million included the principal,

accrued interest to the termination date, and contractual inter-

est, discounted at the appropriate U.S. Treasury rate plus 50

basis points. The net loss on extinguishment of debt of $45.4

million included the make whole payment, removal of deferred

issuance costs, and recognition of a previously deferred gain

related to an interest rate swap.

Our net miscellaneous income (expense) consists of equity

in the earnings of our joint venture investments, royalty and

franchise income, and realized gains and impairments of other

investments. Our equity-method investments are non-controlling

interests in office supply selling operations outside of the United

States and Canada. Earnings from these investments increased