Office Depot 2004 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2004 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

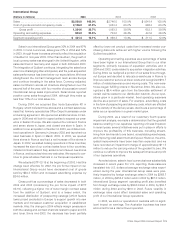

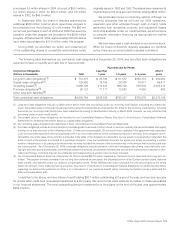

International Group

(Dollars in millions) 2004 2003 2002

Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $3,580.8 100.0% $2,746.5 100.0% $1,641.4 100.0%

Cost of goods sold and occupancy costs . . 2,196.2 61.3% 1,653.2 60.2% 988.3 60.2%

Gross profit . . . . . . . . . . . . . . . . . . . . . . 1,384.6 38.7% 1,093.3 39.8% 653.1 39.8%

Operating and selling expenses . . . . . . . . . . 953.2 26.6% 724.0 26.4% 441.6 26.9%

Segment operating profit. . . . . . . . . . . . . . . . $ 431.4 12.1% $ 369.3 13.4% $ 211.5 12.9%

Sales in our International Group grew 30% in 2004 and 67%

in 2003. In local currencies, sales grew 21% in 2004 and 52%

in 2003, though those increases primarily reflect the acquisition

of Guilbert in mid-year 2003. Other than Guilbert, the growth in

local currency sales was strongest in the United Kingdom, while

sales declined in Germany and Japan in both 2004 and 2003.

The integration of Guilbert continues. Integrating the sales force

was more challenging than anticipated, and the post-acquisition

sales performance has been below our expectations. We have

strengthened the contract management team across Europe

and continue investing in the sales force. Currency adjusted,

sales contribution across all channels strengthened over the

second half of the year, with four months of successive overall

International Group sales improvement. Retail stores reported

positive comp sales throughout 2004, although they make up

less than 10% of our total sales mix.

During 2004, we acquired Elso Iroda Superstore Kft in

Hungary, which included three stores and a contract sales busi-

ness that formerly operated as Office Depot businesses under

a licensing agreement. We opened an additional store in Hun-

gary in 2004 and will look for opportunities to expand our pres-

ence in Eastern Europe. We also opened four stores in France

and seven stores in Japan, and closed one store in Spain. In

addition to our acquisition of Guilbert in 2003, we initiated con-

tract operations in Germany in January 2003 and launched our

retail business in Spain in March 2003. In 2003, we opened

three stores in France and had a net increase of five stores in

Japan. In 2002, we added catalog operations in three countries,

increased the size of our contract sales force in four countries,

initiated contract sales in Italy, added a net of seven new stores

in France, and launched nine new web sites. We expect to con-

tinue to grow all sales channels in our European operations.

We adopted EITF 02-16 at the beginning of 2003. Had this

change been effective for 2002, the pro forma impact on our

International Group would have decreased cost of goods

sold by $24.3 million and increased advertising expense by

$24.6 million.

Gross profit as a percentage of sales decreased in both

2004 and 2003 (considering the pro forma impact of EITF

02-16), reflecting a higher mix of lower margin contract sales

from the addition of Guilbert, and to a lesser extent, the

increased distribution of prospecting catalogs (which feature

lower priced products) in Europe to support growth into new

markets and increased customer acquisition in established

markets. Also, the change in 2004 reflects margin pressures in

both the catalog and contract channels related to paper and ink

and toner. Since mid-2003, the decrease has been partially

offset by lower net product costs from increased vendor pur-

chasing discounts achieved with higher volume following the

Guilbert acquisition.

Operating and selling expenses as a percentage of sales

have been higher in our International Group than in our other

segments, primarily because of expansion activities, and in

2004 and 2003, costs related to acquisition integration activities.

During 2004, we realigned a portion of our sales force through-

out Europe and decided to relocate a warehouse in France to

improve customer service at lower costs and recognized $16.7

million of related severance and moving costs. The new ware-

house began fulfilling orders in November 2004. We also rec-

ognized a $9.4 million gain from the favorable settlement of

certain claims related to our distribution network. As our oper-

ations grow in a particular market, fixed operating expenses

decline as a percent of sales. For example, advertising costs

in the form of prospecting and delivery costs, which are affected

by the density of the delivery areas, decline as a percentage of

sales as our operations in a given market grow.

During 2004, as a result of our customary fourth quarter

impairment analysis, we made a determination that the goodwill

balance existing in our Japanese reporting unit was impaired.

In recent years, several initiatives were put in place in efforts to

improve the profitability of this business, including stream-

lining from two brands to one brand, consolidating warehouses,

and improving retail assortment and layout. However, the antic-

ipated improvements have been less than expected, and we

have recorded an impairment charge of approximately $11.5

million to reduce the carrying value of the goodwill to zero. We

continue our efforts to improve the sales performance and profit

of our Japanese operations.

As noted above, sales in local currencies have substantially

increased in recent years. For U.S. reporting, these sales are

translated into U.S. dollars at average exchange rates experi-

enced during the year. International Group sales were posi-

tively impacted by foreign exchange rates in 2004 by $268.7

million, in 2003 by $253.2 million and in 2002 by $67.0 million.

International Group segment operating profit also benefited

from foreign exchange rates by $36.8 million in 2004, by $32.7

million during 2003 and by $9.0 in 2002. Future volatility in

exchange rates could affect translated sales and operating

profit of our International Group operations.

In 2003, we sold our operations in Australia with no signif-

icant impact on earnings. The Australian business has been

accounted for as a discontinued operation.

Office Depot 2004 Annual Report |25