Office Depot 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20 |Office Depot 2004 Annual Report

Item 7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations.

Results of Operations

General

Office Depot, Inc. is a global supplier of office products and

services. We sell to consumers and businesses of all sizes

through our three business segments: North American Retail

Division, Business Services Group, and International Group.

Our management views our overall business in the context of

the performance of these three principal business segments.

These segments include multiple sales channels consist-

ing of office supply stores, a contract sales force, Internet sites,

and catalog and call centers, all supported by our crossdock,

warehouse and delivery operations. Each of these segments is

described in more detail in Item 1, Business. We operate on

a 52- or 53-week fiscal year ending on the last Saturday in

December. All years in the discussion below contained 52

weeks. Fiscal year 2005 will include 53 weeks.

Forward Looking Statements

This Management’s Discussion and Analysis of Financial

Condition and Results of Operations (“MD&A”) is intended to

provide information to assist you in better understanding our

business. We recommend that you read this MD&A in con-

junction with our Consolidated Financial Statements and the

Notes to those statements. This MD&A contains significant

amounts of forward-looking information, and is qualified by our

Cautionary Statements regarding forward-looking information.

You will find some of our Cautionary Statements throughout this

MD&A; however, most of them can be found in a separate

section immediately following this MD&A. Without limitation,

wherever in this Annual Report we use the words “believe,”

“estimate,” “plan,” “expect,” “intend,” “anticipate,” “continue,”

“project,” “should,” and similar expressions, we are identifying

forward-looking statements, and our Cautionary Statements

apply to these terms and expressions and the text in which such

terms and expressions are used. The purposes of this MD&A

include providing the reader with the perspectives of our man-

agement on our business, and providing you with insights that

are not necessarily obvious or clear from reading our financial

statements (including footnotes) alone.

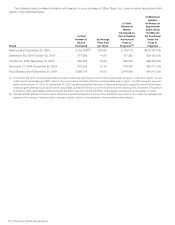

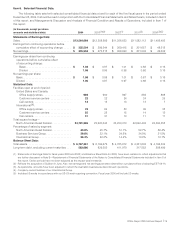

Restatement of Financial Statements

On February 7, 2005, the Chief Accountant of the U.S.

Securities and Exchange Commission (“SEC”) released a letter

expressing the SEC’s views on certain lease accounting mat-

ters. We have identified areas where our historical accounting

practices have differed from the SEC’s views as to appropriate

lease accounting under generally accepted accounting prin-

ciples (“GAAP”). We have consistently accounted for leases

in accordance with our interpretation of generally accepted

accounting principles and common industry practice. However,

we have restated our financial statements for prior periods to

correct these errors. We do not consider the differences in prior

years’ financial statements to be material.

We have reviewed our property lease portfolio and

adjusted initial lease terms to include option renewals that are

reasonably assured of being exercised and included the

straight-line effect over the lease term of escalating rents dur-

ing the option periods and have recognized the effect of pre-

opening “rent holidays” over the related lease terms. We have

also reviewed our leasehold improvements to ensure amortiza-

tion over the shorter of their economic lives or the adjusted

lease term. Tenant allowances have been reclassified from a

contra asset in property and equipment, net to other long-term

liabilities in the Consolidated Balance Sheets. Tenant allow-

ances have also been reclassified from a reduction of depreci-

ation and amortization expense to a reduction of rent expense

in the Consolidated Statements of Earnings and from a reduc-

tion of capital expenditures to an increase in cash provided by

operating activities in the Consolidated Statements of Cash

Flows. Retained earnings at the beginning of fiscal year 2002

have been adjusted for the after-tax impacts of earlier periods.

While we do not consider the net dollar amounts to be

material to net earnings, financial position or net cash flows for

the periods presented, we believe it is appropriate to align our

historical accounting results with the SEC’s comments on lease

accounting under GAAP, and we have done so, as reflected in

our decision to restate results for certain prior years. These

accounting changes reduced net earnings by $2.8 million and

$2.1 million for the fiscal years ended 2003 and 2002, respec-

tively, and resulted in a $42.1 million reduction in retained earn-

ings at the beginning of fiscal year 2002.

See Note B to the Consolidated Financial Statements for a

summary of the effects of these changes on our Consolidated

Balance Sheets as of December 27, 2003, as well as on our

Consolidated Statements of Earnings and Cash Flows for fiscal

years 2003 and 2002. The accompanying MD&A gives effect

to these corrections.

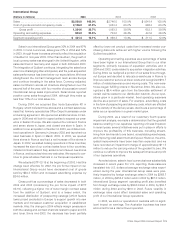

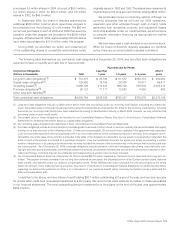

Overview

Full year net earnings were higher in 2004, compared to the

previous two years. The 2004 increase reflects a significant

fourth quarter contribution from volume rebates and event-

based promotional incentives received from our vendors. While

we estimate these effects throughout the year, our full year con-

tribution from these programs exceeded our earlier expecta-

tions. We increased purchases during the fourth quarter to add

inventory for early 2005 initiatives and to protect against certain

anticipated product cost increases. We do not consider these

increases to be outside the normal parameters of our purchas-

ing for these needs. The higher purchases resulted in reaching

higher volume rebate tiers with some vendors and therefore

additional rebate amounts on related purchases for the year. To

the extent the additional rebates related to product sold during

the year, that amount was included in fourth quarter earnings;

the remaining amount was deferred in inventory. The increase

in event-based support resulted from finalization of program

agreements with vendors for promotional activity that occurred

throughout the year. The fourth quarter 2004 results also include

charges related to actions designed to streamline operations,